Real Estate and Art Tokenization: A Guide to Affordable Investments in Europe

20 January 2025

6 min for read

Imagine investing in prime Paris real estate or owning a piece of a Picasso masterpiece with just €50. What once required millions in capital is now possible through asset tokenization, a revolutionary approach transforming Europe's investment landscape.

Traditional real estate and fine art investments have long been exclusive to wealthy individuals and institutional investors. Today, blockchain technology enables fractional ownership of these premium assets, making them accessible to a broader range of investors across Europe.

The European tokenized asset market is rapidly expanding, with real estate and art leading the way. Whether you're looking to diversify your portfolio or make your first investment, understanding how tokenization works, its regulatory framework, and associated risks is crucial for making informed decisions.

Understanding Asset Tokenization in Europe

When you dive into asset tokenization, you're entering a revolutionary space where traditional assets are transformed into digital tokens on a blockchain. This process allows for unprecedented accessibility and trading efficiency of real-world assets.

What is Asset Tokenization and How it Works

Asset tokenization converts ownership rights into digital tokens stored on a blockchain. You can think of these tokens as digital certificates representing your ownership stake in various assets, from real estate to artwork. The technology brings several key advantages:

- Fractional ownership enabling smaller investment amounts

- Enhanced market liquidity through easier trading

- Increased transparency via blockchain technology

- Reduced transaction costs through automation

European Regulatory Framework

The European Union has established itself as a global leader in digital asset regulation. The Markets in Crypto-Assets Regulation (MiCA), which entered into force in June 2023, provides a comprehensive framework for crypto-assets not covered by existing financial services legislation. Additionally, the DLT Pilot Regime, effective from March 2023, allows market infrastructures to trade tokenized financial instruments on distributed ledger technology platforms.

Market Size and Growth Potential

The European tokenization market shows remarkable growth potential. The market size did already reach USD 21.26 Billion in 2023, with projections indicating growth to USD 30.35 Billion by 2031. This expansion is driven by several factors:

- Approximately 35% of European adults had engaged with cryptocurrency investments or tokenized assets by 2021

- Over 60% of European institutional investors plan to increase their exposure to tokenized assets

- European nations have collectively invested more than €350 million in blockchain initiatives

The European Union currently holds approximately 25% of the global tokenization market share, positioning itself as a significant player in this innovative financial landscape. This strong market position is reinforced by progressive regulatory strategies and increasing institutional adoption.

Real Estate Tokenization Opportunities

The real estate tokenization landscape in Europe is transforming rapidly, offering you unprecedented access to property investments that were once reserved for institutional investors. Let's explore the diverse opportunities available in this innovative market.

Types of Tokenized Properties in Europe

European real estate tokenization spans various property types, from commercial buildings to residential complexes. You'll find opportunities in luxury properties through platforms like WeInvest Capital Partners' Premium Real Estate Fund, which has plans to raise €60 million for premium-located real estate investments. The market particularly excels in commercial properties, with platforms enabling fractional ownership of office buildings and shopping centers.

Minimum Investment Requirements

One of the most compelling aspects of tokenized real estate is its accessibility. Through various platforms, you can start investing with as little as €40. This democratization of real estate investment means you can:

- Build a diversified property portfolio across different regions

- Generate rental income from your fractional ownership

- Trade your tokens on secondary markets for improved liquidity

Popular European Real Estate Platforms

The European market hosts several established platforms that make property investment more accessible. Here are some leading platforms and their unique features:

Smartlands: Focuses on regulated security tokens and prioritizes investor protection

Blockimmo: A Swiss-based platform that has successfully tokenized several properties, offering transparent and secure trading of fractional ownership

BrickMark: Provides comprehensive services including:

- Fractional ownership management

- Escrow services

- Automated rent distribution

These platforms utilize blockchain technology to ensure secure transactions and maintain transparent records of ownership. For instance, ADDX has tokenized over CZK 2,343.57 million in assets, demonstrating the growing scale of tokenization in Europe.

The market shows promising growth potential, with projections indicating significant expansion in the next five years. Tokenization is expected to generate revenue of CZK 98.43 billion for the global real estate industry, with Europe maintaining a strong position in this innovative sector.

Art Tokenization Landscape

The art world is experiencing a revolutionary transformation through tokenization, making masterpieces accessible to investors through blockchain technology. Let's explore how this innovation is reshaping Europe's art investment landscape.

European Art Market Overview

The European art market presents a compelling investment opportunity, with the global Real World Asset (RWA) tokenization market valued at approximately €4.9 billion in 2023. Your entry into this market has become significantly more accessible, with platforms like Splint Invest allowing investments starting from just €50.

Digital Art vs Physical Art Tokenization

When you're considering art investments, understanding the distinction between digital and physical art tokenization is crucial:

Physical Art Tokenization:

- Requires thorough authentication and appraisal

- Assets stored in specialized facilities with optimal conditions

- Ownership rights recorded on blockchain through regulated banks

Digital Art Tokenization:

- Direct tokenization of digital artworks

- Immediate verification through blockchain

- Smart contracts managing royalty distributions

Leading Art Investment Platforms

Your journey into art investment is supported by several established platforms in Europe. Artemundi and Sygnum Bank made history by tokenizing Picasso's "Fillette au Béret," creating 4,000 tokens priced at 1,000 Swiss francs each. This groundbreaking initiative demonstrates how tokenization platforms are:

- Enhancing market liquidity through fractional ownership

- Providing transparent ownership records

- Enabling automated royalty payments to artists

- Ensuring regulatory compliance

The platforms operate across 44 European countries, offering various investment models including equity, debt, and P2P lending opportunities. Through these platforms, you're not just investing in art; you're participating in a market transformation that's making fine art investment more democratic and accessible than ever before.

Investment Strategy and Risk Management

Building a successful investment strategy in tokenized assets requires careful planning and understanding of unique risks. Let's explore how you can create a robust investment approach while navigating the complexities of this innovative market.

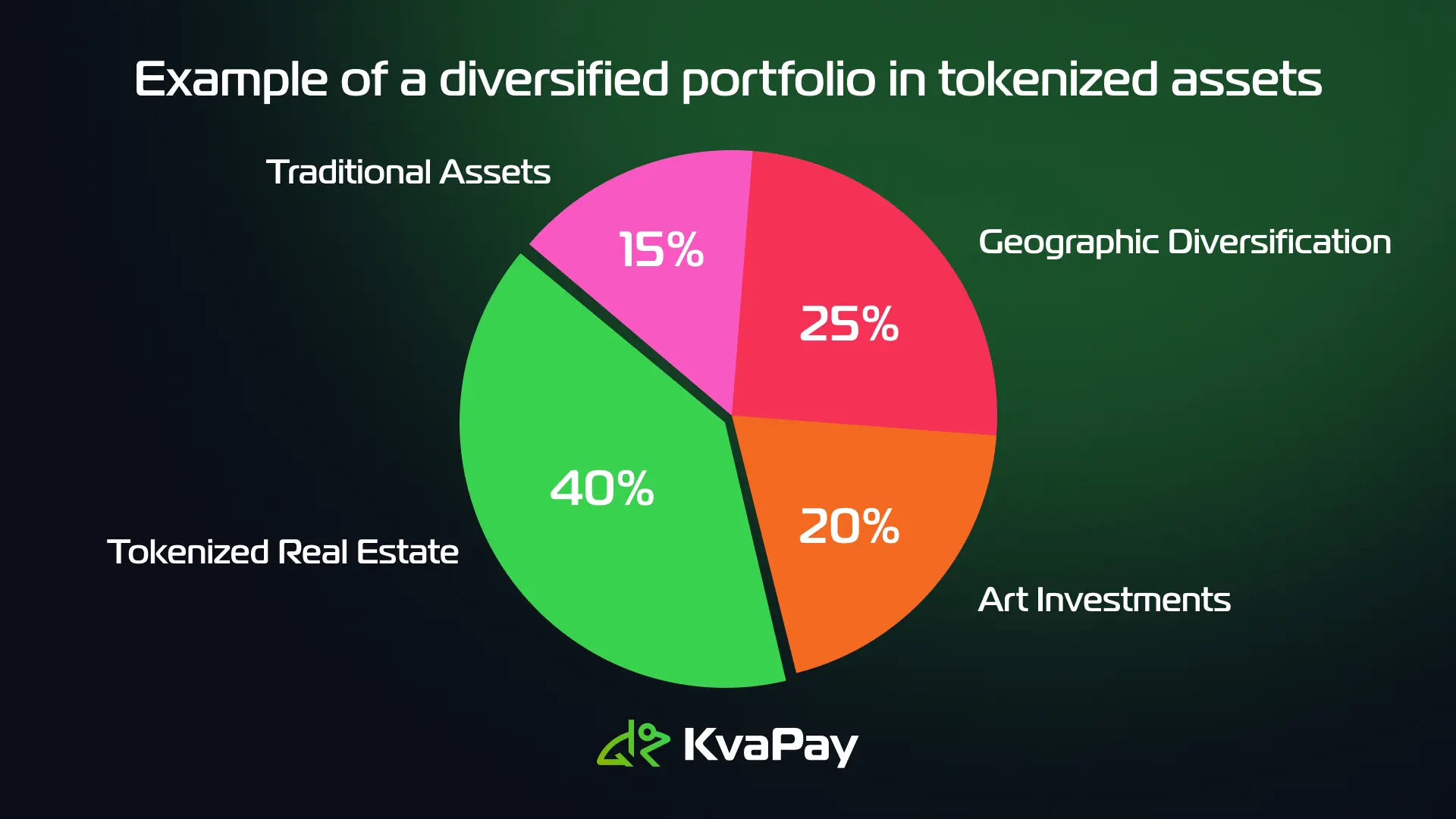

Portfolio Diversification Techniques

Smart diversification in tokenized assets goes beyond traditional investment principles. You can now spread your investments across multiple asset classes through tokenization, which allows for:

- Real estate tokens combined with art investments

- Geographic diversification across European markets

- Mixed portfolio of traditional and tokenized assets

- Varying investment horizons and risk levels

This approach helps minimize risk while maximizing potential returns. For instance, you can invest in tokenized real estate for stable returns while allocating a portion to art tokens for potential value appreciation.

Conclusion

Asset tokenization has created new paths for you to invest in premium real estate and fine art across Europe. Through blockchain technology and regulatory frameworks like MiCA, these investments now require minimal capital, allowing you to own fractions of high-value assets starting from €50.

The European tokenized asset market continues to expand, projected to reach USD 30.35 Billion by 2031. Make sure you follow KvaPay on social media to stay updated with new articles about these emerging investment opportunities. As regulations mature and technology advances, tokenization promises to make premium asset investments increasingly accessible for any investor.

Tags:

Share: