How to Use Stablecoins for Currency Exchange and Capital Protection

27 February 2025

7 min for read

Traditional international wire transfers can eat up to 5 % of your transaction amount. You'll lose 500 EUR for every 10,000 EUR sent across borders.

Imagine sending money worldwide without expensive fees, long processing times, or unpredictable exchange rates. Stablecoins make this possible.

We'll show you how to use stablecoins effectively for currency exchange and capital protection in this piece. Our coverage includes building a reliable stablecoin reserve and implementing advanced strategies to protect your digital assets.

Are you ready to change how you handle international payments? Let's take a closer look at the possibilities.

Stablecoins Tied on USD and EUR

Cryptocurrency stablecoins like Tether (USDT) and USD Coin (USDC) are reshaping the scene of currency exchange. These digital assets keep their value steady by linking to stable currencies like the US dollar. They protect you from market volatility and enable quick, affordable international transfers.

EUR stablecoins are digital currencies tied to the value of the euro, designed to maintain price stability. This stability makes them well-suited for short-term and medium-term purposes, serving effectively as both a unit of account and a store of value. EUR stablecoins with highest market capitalization are STASIS EURO (EURS), Euro Coin (EURC) and Tether EURt (EURT).

The STASIS EURO is a digital financial asset created to replicate the value of the euro at a 1:1 ratio. The value of the EURS token is directly linked to its underlying collateral, ensuring stability and trust for users. Euro Coin is a digital currency issued by Circle, operating under the same full-reserve model as USD Coin (USDC), a widely trusted dollar-backed stablecoin with over 51,9 billion EUR in circulation. Tether EURt is a stablecoin designed to maintain parity with the value of the euro, issued by the Hong Kong-based company Tether.

Strategic Role of Stablecoins in Financial Planning

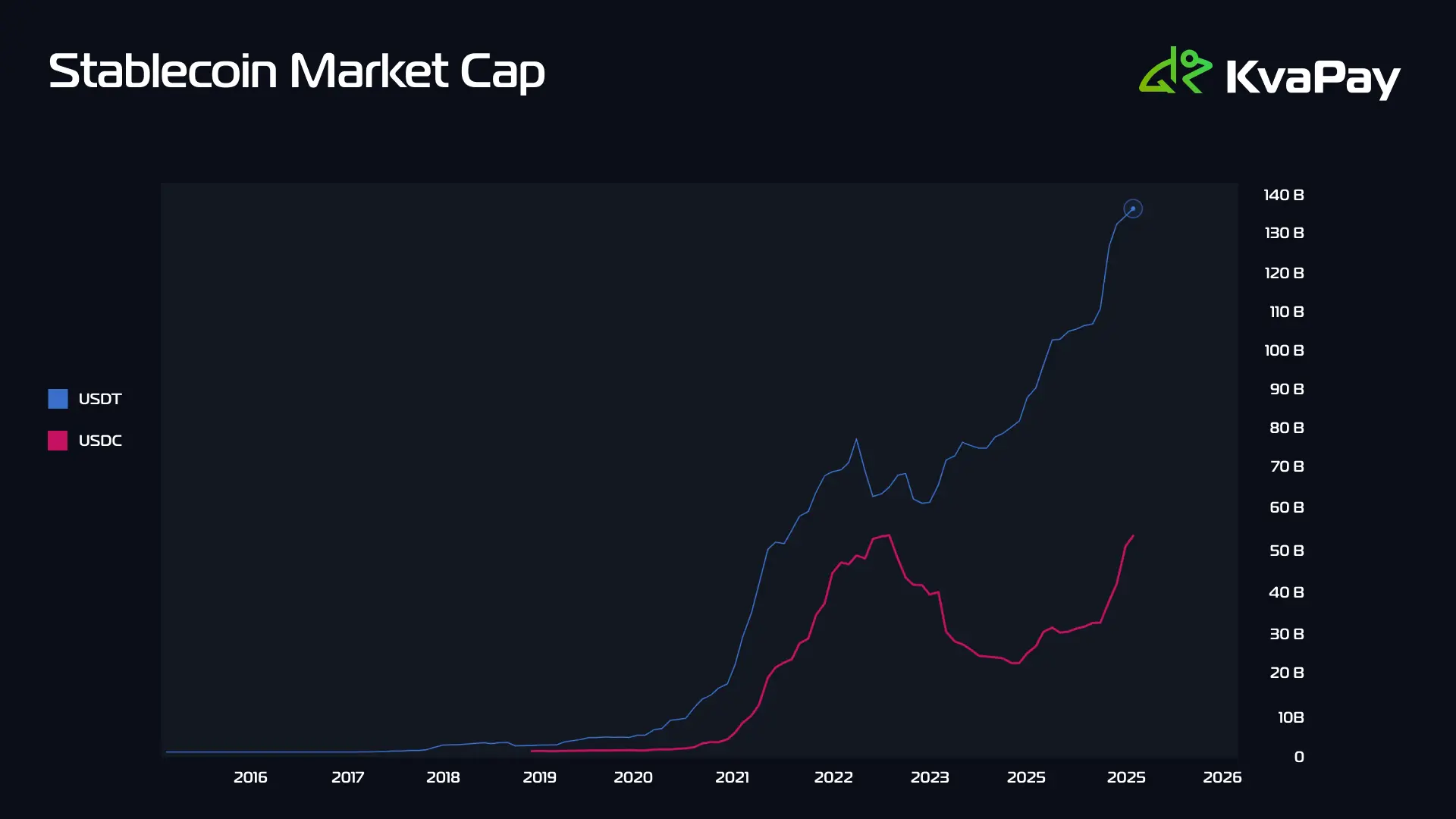

Stablecoins are reshaping the scene of treasury management and investment strategies. The stablecoin market cap has grown to an impressive value exceeding 193 billion EUR, which shows their expanding role in financial planning. Usually stablecoins go along with the traditional bull market of other main cryptocurrencies and follow the trend.

Evaluating Stablecoins as a Treasury Tool

Stablecoins have emerged as a powerful tool for treasury operations, especially when you have cross-border transactions. These digital assets are a great way to get advantages compared to traditional banking methods:

- Instant settlement capabilities

- Lower transaction costs

- 24/7 operation availability

- Programmable payment automation

- Better liquidity management

Corporate treasuries can streamline global transactions and reduce fees and counterparty risk with stablecoins. Smart contracts make them attractive to businesses that manage repeated payments from multiple sources because they automate many treasury functions.

Integration with Investment Portfolios

Stablecoins serve as an excellent hedge against market volatility in crypto portfolios. Their low conditional correlations with cryptocurrency portfolios make them ideal for risk management. Stablecoins act as a financial haven during crypto market declines, which allows quick movement of assets into a stable medium.

Building a Stablecoin-Based Currency Reserve

A reliable stablecoin reserve needs thoughtful planning and smart resource allocation. The stablecoin market cap has reached 199 billion EUR on 9th of december 2024. This creates many opportunities to build a resilient currency reserve.

Using Different Types of Stablecoins

Your portfolio becomes more resilient when you spread investments across multiple stablecoins. Here's why using different stablecoins matters:

- You reduce the risk from depending on a single issuer

- You get access to different ecosystems

- You can manage liquidity better

- You alleviate the impact of depegging events

- You find different ways to earn yields

Liquidity Management Strategies

The right balance between accessibility and yield drives our liquidity management approach. USDC's strategy shows this balance perfectly. They keep about 80% of reserves in short-dated U.S. Treasuries and 20% in cash deposits. Successful strategies often place reserves in segregated accounts. This protects assets even during unexpected events.

Reserve Allocation Models

Major stablecoin issuers have proven strategies that shape our recommended reserve allocation model. This balanced approach works well:

| Asset Type | Allocation | Purpose |

| Short-term Treasuries | 70-80% | Stability & Yield |

| Cash Deposits | 15-20% | Immediate Liquidity |

| Other Stablecoins | 5-10% | Ecosystem Access |

This model lines up with market leaders' methods while keeping enough liquidity for currency exchange operations. Clear and transparent reserve structures build trust and ensure stability. This becomes especially important when stablecoins handle international payments.

Optimizing International Business Operations

Stablecoin adoption brings a fundamental change to international business operations. The daily trading volumes surpasse more than 117 billion EUR. This shows growing trust in these digital assets.

Cross-Border Payment Solutions

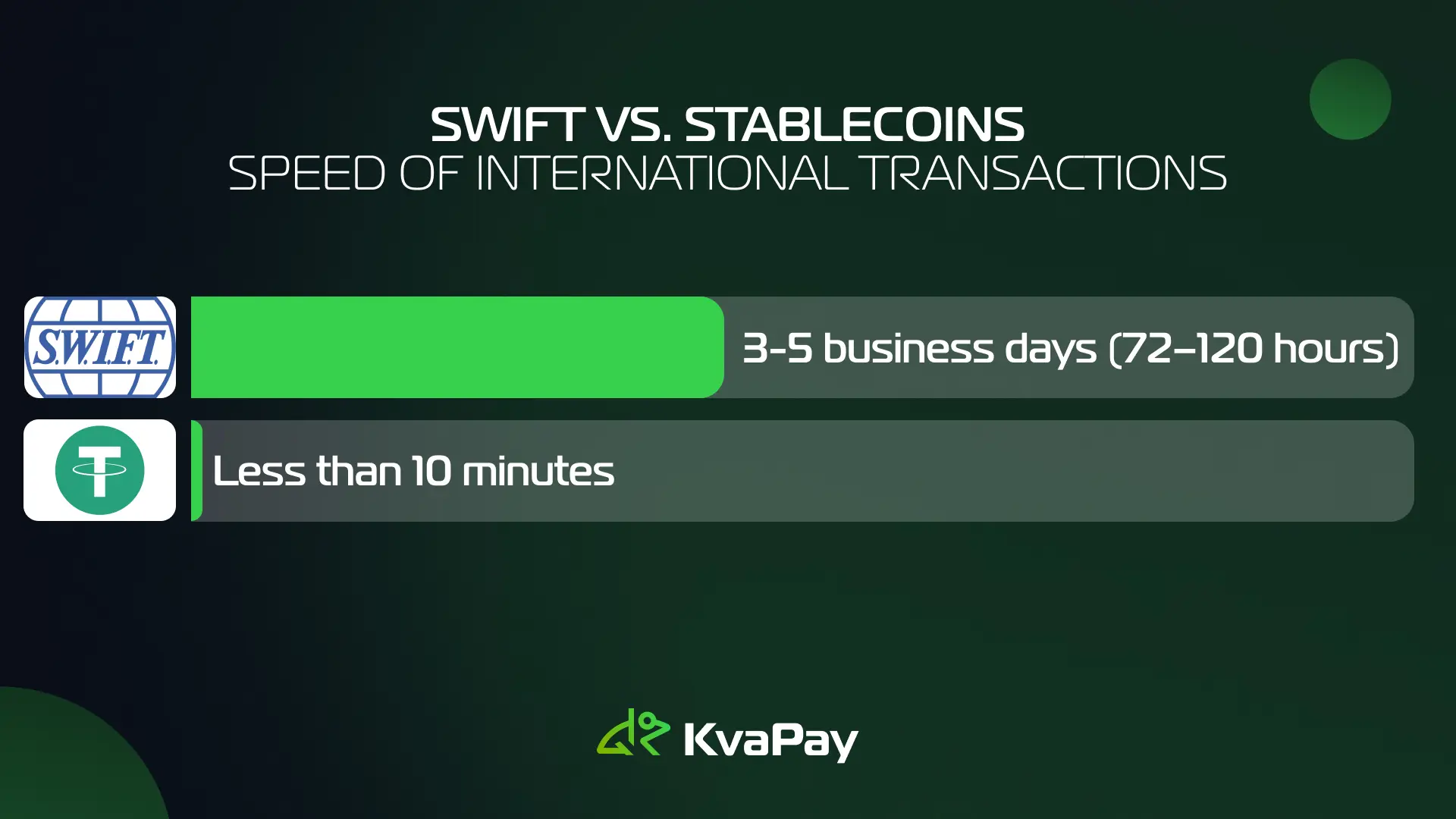

Stablecoins are changing traditional payment systems by cutting down settlement times. Traditional SWIFT transfers take 3-5 business days, but stablecoin transactions complete in minutes. The benefits go beyond speed - studies indicate that on-chain FX can cut remittance costs by up to 80% in some cases.

Vendor Payment Strategies

Stablecoins prove excellent for vendor payment optimization. These digital assets have become essential because they offer:

- Settlements happen instantly whatever the banking hours

- Transaction fees are lower than traditional methods

- Blockchain provides better payment visibility

- Currency conversion becomes easier

- Transactions can be tracked in real time

Recent data reveals that 84% of businesses operating in over 10 countries use blockchain technologies including stablecoins. This shows their growing popularity in vendor payment systems.

Working Capital Management

Stablecoin implementation improves working capital efficiency substantially. Traditional B2B payment systems currently hold 11,1 billion EUR of business capital. Companies can free this capital 3-6 days faster on major payment routes by using stablecoins.

The numbers tell an impressive story. This optimization could bring a 2.8 billion EUR return for businesses on just four major payment routes by 2027. This marks a fundamental change in working capital management, especially for companies that operate with multiple currencies and jurisdictions.

Advanced Stablecoin Protection Strategies

Our work with digital asset protection shows that advanced stablecoin strategies need a sophisticated risk management approach. There are complete methods that protect your digital assets and maximize their value in international transactions.

Multi-Currency Hedging Techniques

Stablecoins work as effective hedges under normal market conditions and become safe havens when markets turn volatile. Your protection against market swings improves when you spread investments across different stablecoin types. Studies show that stablecoins keep low conditional correlations with cryptocurrency portfolios, which makes them excellent hedging tools.

Smart Contract Automation for Risk Management

Smart contracts have brought remarkable advances in automated risk management. To cite an instance, Aave's Edge Risk Oracle has cut risk parameter adjustment times from 96 hours to under one minute. The key protection features now include:

- Live optimization of risk parameters

- Automated circuit breakers for market stress

- Dynamic collateral management

- Continuous monitoring of stability metrics

Conclusion

Stablecoins are great tools that help businesses and people who need quick currency exchange and capital protection. These digital assets keep their value steady and let you transfer money almost instantly at low costs, which makes them perfect for international business.

Stablecoins shine in many areas. Companies use them to manage treasury operations and investment portfolios. They work exceptionally well for cross-border payments and working capital optimization. Smart contracts automate processes automatically, and multi-currency hedging adds extra protection. A proper reserve allocation will give you stability and the liquidity you need.

International payment success depends on knowing how to use stablecoin solutions properly. You can substantially cut transaction costs and protect your capital from market swings through careful planning, strategic implementation, and reliable protection measures.

Stablecoin success needs constant attention to market trends, regulatory updates, and risk management plans. The best approach is to begin with small steps. Learn as you go and expand your stablecoin operations when you feel more confident with these powerful financial tools.

Tags:

Share: