Why Cryptocurrency Adoption in Emerging Markets Is Breaking All Records in 2025

11 January 2026

5 min for read

In this article, we'll explore why cryptocurrency adoption is breaking records in emerging markets, examine the technological advances driving this growth, and uncover the business opportunities this digital revolution presents.

The Unprecedented Growth of Cryptocurrencies in Emerging Markets

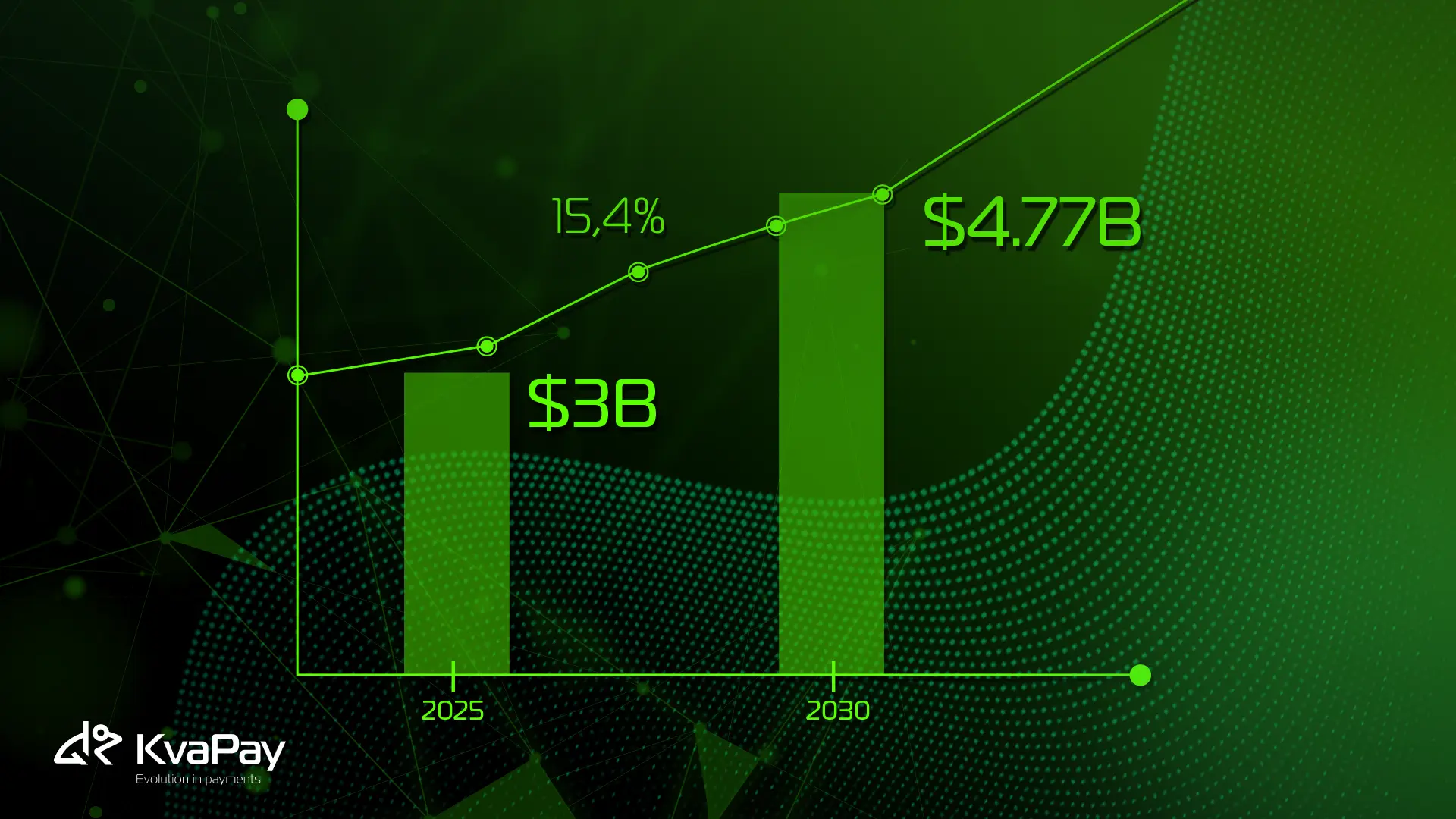

Cryptocurrency adoption in emerging markets has reached unprecedented heights in 2025, creating a financial paradigm shift that's simply reshaping how millions handle their money. The global cryptocurrency market, valued at $ 3 billion in the end 2025, is projected to surge to US$ 4.77 billion by 2030, growing at an impressive 15.4% CAGR.

Record-breaking adoption statistics for 2025

The numbers tell a compelling story of cryptocurrency's accelerating momentum. Approximately 28% of American adults (about 65 million people) now own cryptocurrencies. Furthermore, 14% of non-owners plan to enter the market this year, with 67% of current owners intending to increase their holdings. This growth isn't limited to established cryptocurrencies. Bitcoin remains the blockchain industry leader, but Ethereum, Dogecoin, and Solana are also gaining significant traction. Notably, 43% of people planning to buy cryptocurrencies in 2025 had their sights set on Ethereum.

Key emerging markets leading the cryptocurrency revolution

Central & Southern Asia and Oceania (CSAO) dominate the 2025 Global Crypto Adoption Index, with seven of the top 20 countries located in this region. DeFi activity has increased substantially in Sub-Saharan Africa, Latin America, and Eastern Europe, reflecting how these regions are embracing cryptocurrency's potential to overcome local financial limitations.

In contrast to emerging markets, developed economies generally show more conservative adoption patterns. Cryptocurrency ownership rates remain below one-third in countries like Japan, Argentina, Canada, France, Italy, and the United Kingdom. Despite regulatory challenges, the United States remains a major player in the crypto space, with 43% of respondents reporting wallet ownership. Institutional adoption, particularly from major financial institutions and venture capital, continues to make the US a leading destination for cryptocurrency innovation.

Economic Drivers Behind Record-Breaking Adoption

Economic necessity, rather than speculation, drives cryptocurrency adoption across emerging markets in 2025. Unlike developed nations where investment often dominates crypto narratives, emerging economies embrace digital assets as practical solutions to everyday financial challenges.

Inflation protection in volatile economies

For citizens in countries battling persistent currency devaluation, cryptocurrencies offer a lifeline against wealth erosion. In Argentina, where inflation has historically devastated purchasing power, 87% of residents believe crypto can enhance their financial independence. Similarly, in Turkey, where the lira lost nearly 60% of its value between 2021-2023 as inflation reached 85.5%, many citizens turned to Bitcoin as a store of value. "People in Argentina don't trust the peso. They are always looking for ways to store value outside the local currency," explains one cryptocurrency exchange director.

Overcoming banking limitations

Approximately one-fifth of global respondents expressed interest in using cryptocurrency specifically to overcome traditional banking obstacles. The advantages extend beyond individuals. Research indicates cryptocurrencies can reduce or eliminate intermediaries, allowing customers to transfer money more quickly without additional transaction costs.

Reducing remittance costs

Perhaps the most compelling economic driver is remittance efficiency. Traditional remittance services charge exorbitant fees—averaging 6.20% on international transfers, with bank-based transfers reaching 12.09%. This difference translates to substantial savings. Bitso processed €3.15 billion in remittances from the US to Mexico with fees under 1%, while BitPesa in sub-Saharan Africa maintains fees between 1-3%. Considering traditional services charge up to 20% for transfers to countries like Angola and Botswana, cryptocurrency presents an undeniable economic advantage.

Business Opportunities in the Emerging Market Crypto Boom

Businesses across emerging markets are discovering powerful new opportunities as cryptocurrency adoption expands.

Cross-border trade without currency conversion fees

Traditional international transactions typically involve multiple intermediaries, each adding fees and delays. Cryptocurrencies eliminate these middlemen, substantially reducing transaction costs [2]. For businesses conducting high-volume trade or engaging internationally, these savings become particularly significant. According to recent research, 23% of consumers who made online cross-border payments used at least one form of cryptocurrency. Studies show that 85% of surveyed merchants view crypto payments as a way to reach new customers, while 77% cite lower transaction fees as their primary motivation. Indeed, these merchants recognize that seamless, instant cross-border payments are no longer a distant goal but a present reality.

Accessing previously unreachable markets

Cryptocurrencies provide financial services to the unbanked and underbanked populations in emerging markets with just a smartphone and internet connection. This accessibility opens previously untapped customer segments to forward-thinking businesses. Local cryptocurrency exchanges have emerged specifically to address regional needs, providing fiat on-ramps that allow individuals to convert local currency to cryptocurrency. Businesses integrating cryptocurrency now gain early adopter advantages, positioning themselves for future growth as consumer adoption continues accelerating. Furthermore, they develop internal expertise in blockchain technology, preparing them to capitalize on further innovations as they emerge.

Conclusion

Cryptocurrency adoption in emerging markets stands as a testament to digital currency's practical value beyond investment opportunities. While developed nations often view cryptocurrencies as speculative assets, emerging economies demonstrate their real-world utility for solving critical financial challenges. The evidence speaks clearly through the numbers - from Nigeria's 84% crypto wallet ownership to the projected market growth of 15.4% CAGR by 2030. These statistics reflect how digital currencies address fundamental needs: protection against inflation, access to banking services, and affordable cross-border transactions. Technology continues removing barriers through improved blockchain scalability, mobile-first platforms, and seamless payment system integration. Therefore, businesses embracing cryptocurrencies now position themselves at the forefront of a financial revolution that's already transforming global commerce.