Will Bitcoin Price Reach 200,000 USD in 2025? An In-Depth Analysis

12 February 2025

6 min for read

Bitcoin's price surge beyond 100,000 USD in late 2024 has caught everyone's attention worldwide. The remarkable rally makes investors and analysts curious about where the cryptocurrency might go next. Several shareholders of major global stocks are now trying to persuade company boards to include bitcoin on their balance sheets.

The recent BTC price surge and market patterns raise an interesting question: Can Bitcoin hit 200,000 USD by 2025? A detailed market analysis, technical indicators, and regulatory changes could give us clues about Bitcoin's future direction.

The value of Bitcoin depends on several key factors. Expert opinions and analytical insights help paint a clear picture of this ambitious price target. Market forces and institutional adoption patterns provide valuable context to understand what lies ahead.

Current Market Dynamics Driving Bitcoin's Growth

Bitcoin's market dynamics are changing dramatically due to major institutional adoption. BlackRock's IBIT ETF has become the fastest-growing ETF in history and manages $41 billion in assets in just 11 months. U.S. spot Bitcoin ETFs show this momentum with $35.41 billion in total net inflows.

The market shows several powerful catalysts. These catalysts involve corporate treasury adoption led by industry giants, record-breaking institutional investment flows, Bitcoin halving impact on supply, better regulatory clarity and acceptance.

Corporate treasury adoption has reached impressive levels. Many companies now see Bitcoin as a strategic reserve asset. MicroStrategy leads this trend by holding 478,740 bitcoins on 11th february 2025. More businesses adopt this approach to protect against inflation and currency debasement.

BlackRock CEO Larry Fink's view has changed dramatically. He once saw Bitcoin as 'an index of money laundering' but now calls it ‘digital gold’. This shift in institutional thinking has helped Bitcoin gain broader market acceptance and value.

Technical Analysis and Price Patterns

Technical indicators show compelling evidence that Bitcoin could surge toward the 200,000 USD mark. Bitcoin's 260-day fractal dimension complexity points to a strong upside potential as it drops below the critical 1.20 threshold.

Bitcoin's major moves have followed historical Fibonacci retracement levels with remarkable accuracy. The current analysis points to targets between 173,088 USD and 458,319 USD based on the 1.618 and 2.272 Fibonacci levels respectively.

These key support and resistance levels have caught our attention:

- Primary Support: 93,000 USD

- Critical Resistance: 102,000 USD

- Secondary Support: 89,000 USD

Bitcoin has climbed more than 150% from its 2024 low of about 40,000 USD, which stands out as remarkable.

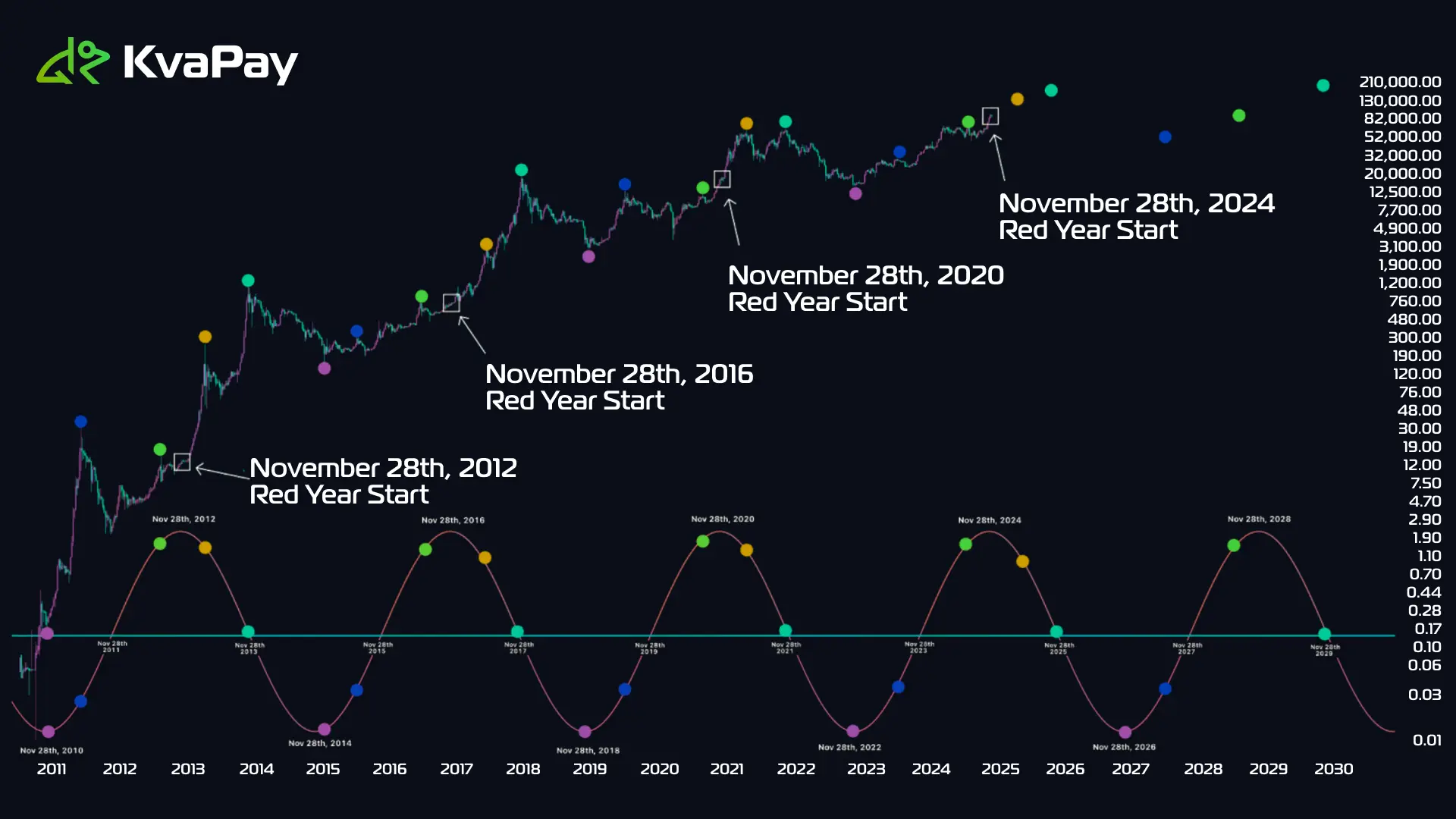

Our technical assessment lines up with historical cycle patterns and suggests we're almost in the end of the typical four-year cycle. Bitcoin typically needs 24-26 months to break past previous highs based on previous cycles. The current movement matches these historical patterns and builds momentum toward the predicted bull market peak around October 2025.

A bull flag pattern on the price charts strengthens our bullish outlook. This technical setup and declining exchange reserves suggest we're entering a phase of exponential gains as we progress through the typical one-year catch-up phase after the halving.

Political and Regulatory Catalysts

Bitcoin's path to 200,000 USD has gained momentum from recent political developments. Donald Trump's election victory has created a wave of optimism in crypto markets, pushing Bitcoin above 100,000 USD for the first time ever.

Recent regulatory changes paint an encouraging picture for Bitcoin's future:

- Paul Atkins, known for his pro-crypto stance, will run SEC

- A crypto advisory council has been established

- The U.S. has launched a Bitcoin reserve initiative

- Crypto firms now have better banking access

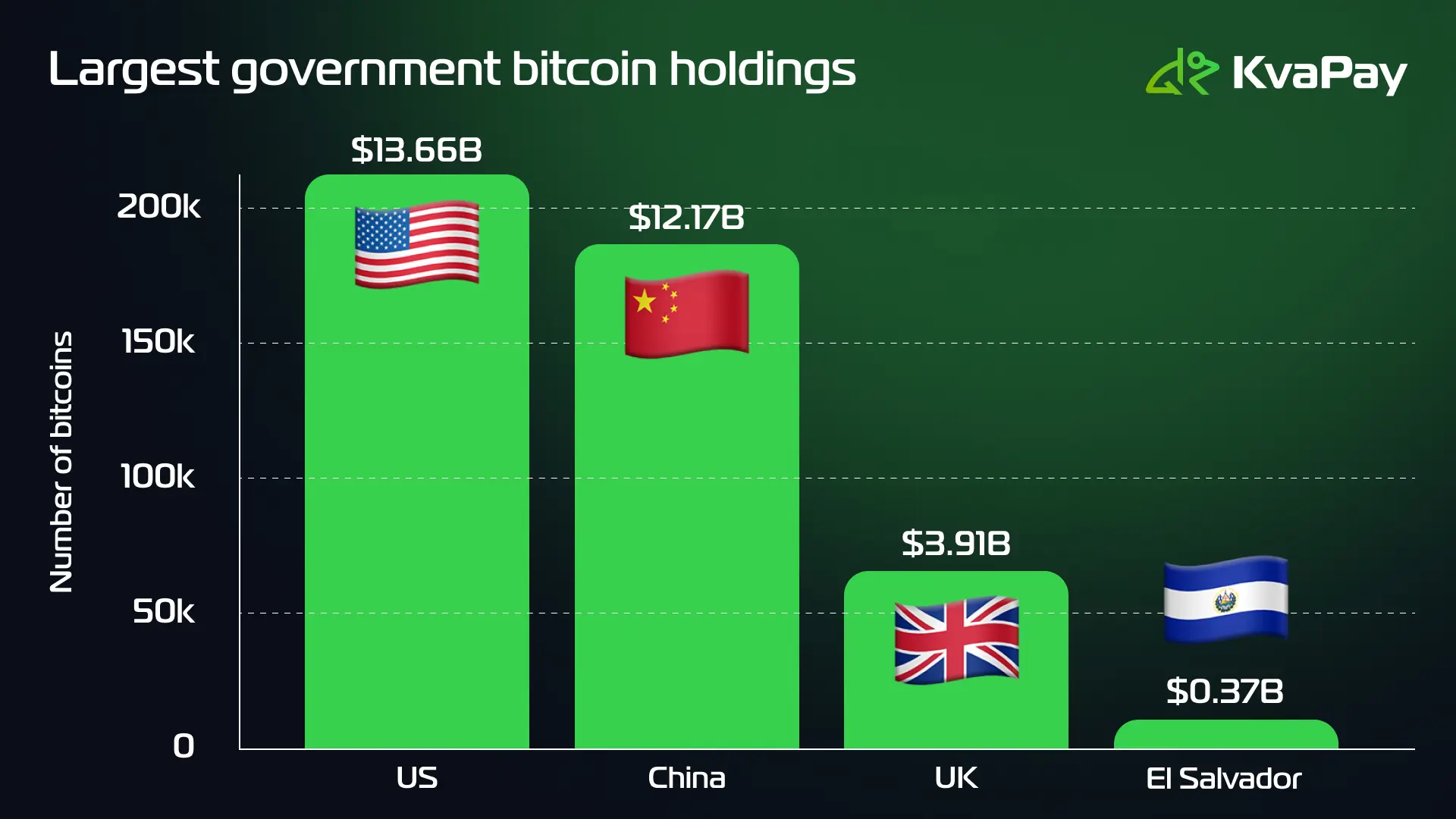

The U.S. strategic Bitcoin reserve proposal stands out. It aims to buy one million BTC in five years. This could lead to a radical alteration in global adoption, especially since governments already hold 567,000 Bitcoins worth over $36 billion.

Regulatory acceptance continues to grow. 33 countries have legalized cryptocurrency, while 17 maintain partial bans. 70% of reviewed countries are making substantial changes to their regulatory frameworks. This shows how cryptocurrency is becoming mainstream.

Spot Bitcoin ETFs have changed the game by attracting more than $4 billion in investments since the election. Trump's promise to make the U.S. the "crypto capital of the planet", combined with growing institutional support, creates perfect conditions for Bitcoin to thrive.

What if Bitcoin stumbles?

High interest rates around the world and other uncertainties related to the global economy can hinder liquidity and investors' willingness to invest in speculative assets such as BTC.

Competition from other tokens, such as ether, and the presence of digital versions of central bank currencies (CBDCs) may dilute much of bitcoin's dominance. The very volatility of bitcoin, coupled with high transaction costs and some environmental costs, could discourage institutional and retail adoption, as some investors may look for more stable alternatives or those with use cases.

In addition, there are geopolitical risks and slowing retail adoption. Digital currency policies will be imbalanced and may favour domestic coins, while retail interest may shift to other technologies such as AI. In addition, bitcoin's slow transaction speed and limited scalability could make it less attractive than newer blockchain systems with better capabilities. All of these factors could contribute to dampening demand, leaving bitcoin unable to deliver on its promise of ever reaching 200 000 USD in 2025.

Conclusion

Bitcoin's price could probably reach 200,000 USD by 2025. This prediction gains strength from recent developments in institutional adoption, technical indicators and better regulations. The market shows strong signs through BlackRock's outstanding ETF performance and MicroStrategy's extensive Bitcoin holdings.

The technical analysis supports this view. Fibonacci levels suggest possible targets ranging from 173,088 USD to 458,319 USD. Recent political changes boost confidence as new regulations and government programs show Bitcoin's growing acceptance. The U.S. government's plan to create a strategic Bitcoin reserve might cause a supply crunch and speed up the price movement toward our target.

Historical patterns don't guarantee future outcomes. Yet this analysis shows Bitcoin's current path matches past trends and key market drivers. The reduced supply after halving combined with rising institutional interest and clearer regulations sets up Bitcoin for strong growth through 2025. Investors should watch these developments carefully and evaluate their risk tolerance before making investment choices.