The Trump Presidency and its Effect on the Cryptocurrency Markets

09 December 2024

4 min for read

Introduction

Donald Trump's re-election has reignited interest in his ambitious vision of establishing a national Bitcoin reserve. This bold initiative could have transformative implications for both the U.S. financial landscape and the global cryptocurrency market. As Bitcoin solidifies its position as the eighth-largest asset globally, surpassing silver, Trump's proposed deregulation of the U.S. crypto environment adds another layer of intrigue. But is this vision realistic, and what challenges lie ahead?

Can Trump Make the U.S. the "Crypto Capital of the World"?

One of Trump's most talked-about campaign promises is his pledge to turn the United States into the "crypto capital of the world." Central to this vision is the establishment of a national Bitcoin reserve.

During a Bitcoin conference in July, Trump outlined plans to leverage the government’s existing Bitcoin holdings—estimated at 200,000 BTC (worth approximately $18 billion, largely seized from criminal activities)—as a foundation for the reserve. The proposal received strong backing from Senator Cynthia Lummis, a vocal Bitcoin advocate. Lummis introduced the Bitcoin Act in mid-2024, which outlines a roadmap for the government to acquire up to 200,000 BTC annually for five years, potentially amassing 1 million BTC, or 5% of the cryptocurrency's total supply.

The Feasibility of a National Bitcoin Reserve

While the concept is groundbreaking, experts are divided on its feasibility. Dr. Arash Aloosh, Assistant Professor of Finance and Fintech at Dublin City University, expressed skepticism, citing multiple barriers.

Aloosh pointed out that:

- Establishing a Bitcoin reserve would require the U.S. government to formally endorse Bitcoin and invest public funds in it—steps that would mark a stark departure from its historically cautious stance on cryptocurrencies.

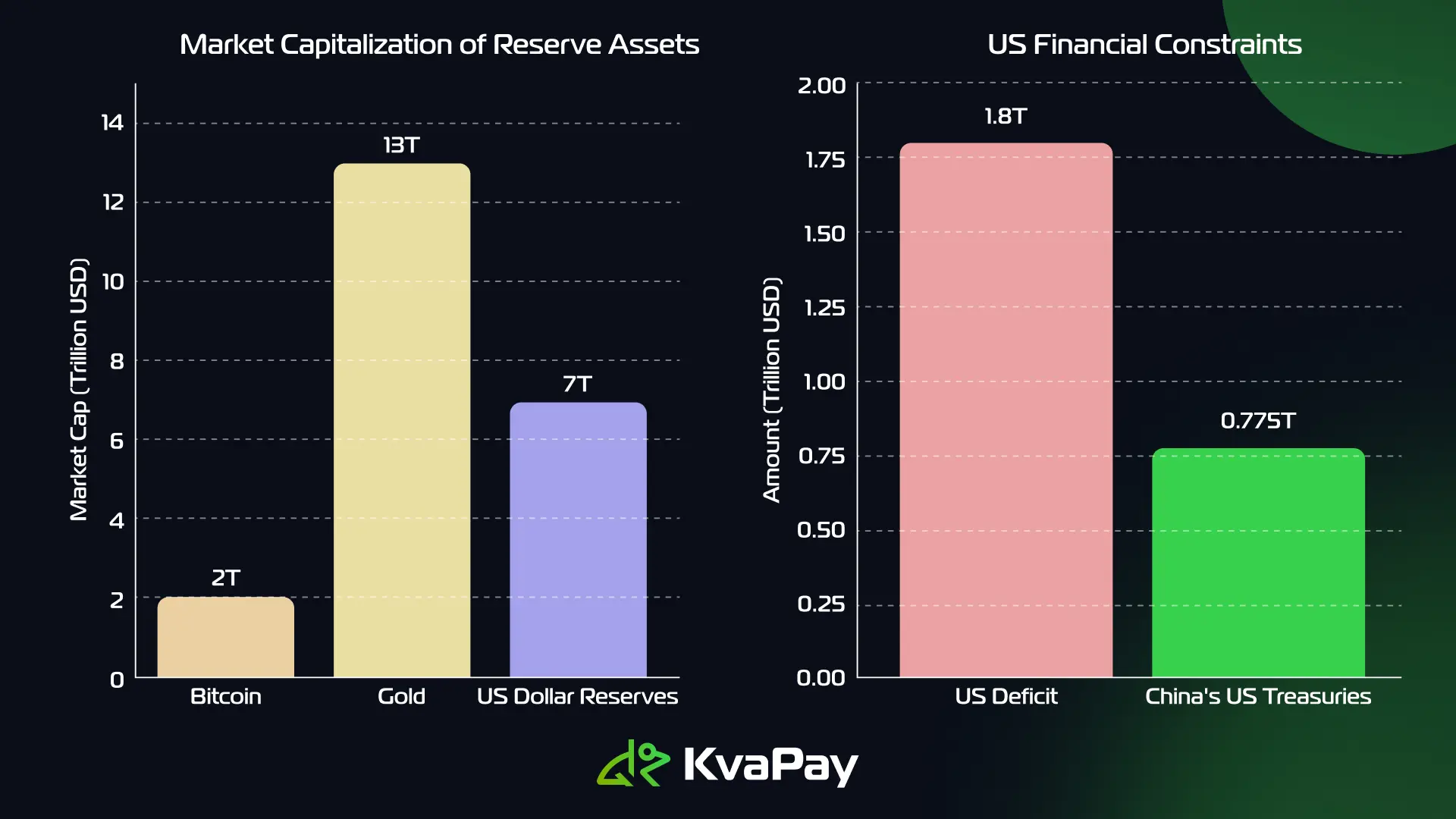

- Bitcoin's current market capitalization of under $2 trillion lacks the scale and stability required for a national reserve asset.

- Large-scale Bitcoin acquisitions could inflate market prices, introducing volatility and additional costs.

- The U.S. budget deficit, currently at $1.8 trillion, raises questions about financing such a venture, especially given the U.S.'s reliance on foreign creditors like China, which holds $775 billion in U.S. Treasuries.

A New Regulatory Landscape

One of Trump’s key promises is to overhaul the regulatory environment. His first target: SEC Chairman Gary Gensler, whom he blames for stifling innovation with a "regulation by enforcement" approach. Trump has vowed to replace Gensler with a more crypto-friendly leader, potentially paving the way for clearer and more growth-oriented policies.

Christopher Perkins, President of CoinFund, views these developments positively:

"The U.S. elections were extremely favorable for the crypto industry. Trump’s pro-crypto stance, combined with the election of 261 pro-crypto Congressional candidates, marks the beginning of what could be the first 'crypto Congress.'”

Catalyst for Mainstream Adoption?

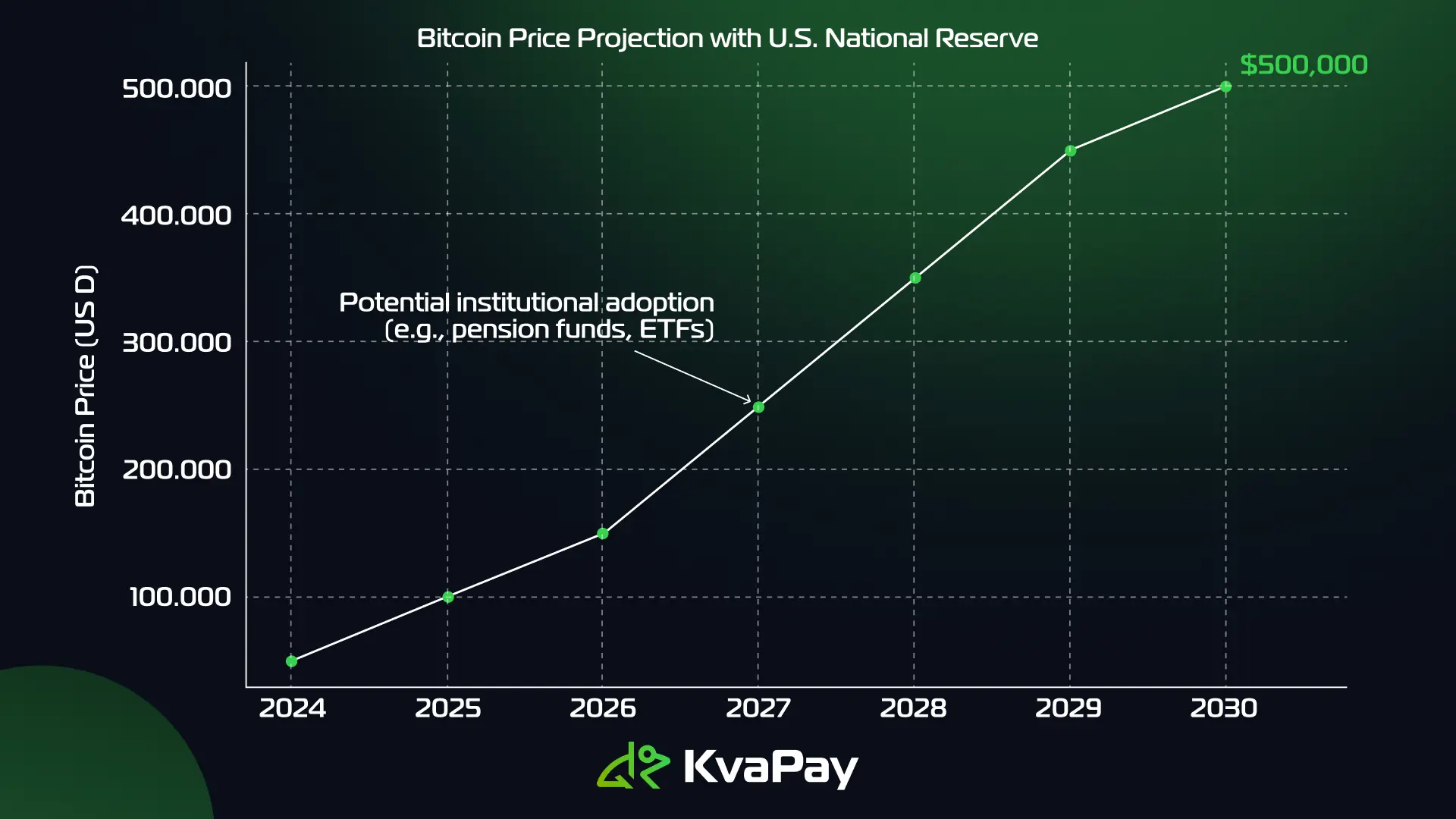

Supporters argue that a national Bitcoin reserve could drive significant growth in the cryptocurrency market. Songping Que, Senior Manager at Neo Blockchain, believes such a move could push Bitcoin prices toward the higher end of analysts' projections, possibly reaching $500,000.

Que explained:

- A U.S. Bitcoin reserve would likely attract institutional investors such as pension funds and sovereign wealth funds, further legitimizing cryptocurrencies.

- Previous market milestones, such as the introduction of Bitcoin ETFs, have demonstrated how institutional adoption can fuel price rallies. A national reserve would amplify this effect.

Trump’s Stance on CBDCs

Trump’s opposition to Central Bank Digital Currencies (CBDCs) stems from concerns about privacy and individual freedoms. His support for the CBDC Anti-Surveillance State Act, which prevents the Federal Reserve from issuing a CBDC without Congressional approval, aligns with these principles. This stance, shared by Federal Reserve Chair Jerome Powell, could influence global discussions around digital currencies.

The Path Forward for U.S. Crypto

Despite previous regulatory challenges, the U.S. cryptocurrency sector remains a hub of innovation. With Trump’s pro-crypto administration, combined with a supportive Congress, the U.S. has a unique opportunity to position itself as a global leader in decentralized finance.

Trump's anti-CBDC stance could also encourage central banks worldwide to rethink centralized models, fostering more open and competitive systems. Rhys Bidder, Deputy Director at the Qatar Centre for Global Banking and Finance, highlighted the potential for the crypto industry to mature under Trump’s leadership:

"There have been false dawns for crypto before. The hope is that this administration creates sustainable growth and credibility for the sector."

Tags:

Share: