A Bitcoin ETF works as a regulated investment tool that follows Bitcoin's price movements. Investors buy and sell shares right from their brokerage accounts. This new development raises a vital question: Which option suits you better - a Bitcoin ETF or direct Bitcoin ownership? Both choices come with their own benefits and challenges, ranging from security aspects to fee structures.

Our detailed comparison of these investment methods covers costs, risks, and real-world implications for different investors. This analysis will help you learn which choice lines up with your investment objectives, risk comfort level, and overall portfolio approach.

Understanding Investment Options

The mechanics of both Bitcoin investment approaches have unique characteristics that we should understand better.

Spot Bitcoin ETFs Explained

Professional fund managers handle everything about Bitcoin acquisition and custody in spot Bitcoin ETFs. Each ETF share represents a portion of actual Bitcoin kept in secure storage. These fund managers use institutional-grade custody solutions and keep Bitcoin safe through advanced security measures like cold storage and multi-signature wallets.

Also, depending on the local jurisdiction, ETF trading may not be available to all prospective buyers. Thus, it is a centralized BTC ownership solution that relies on an intermediary and is limited by geolocation.

Direct Bitcoin Ownership Mechanics

Direct Bitcoin ownership puts you in complete control of your cryptocurrency holdings. You'll manage your digital wallets and private keys yourself. This gives you maximum flexibility and control, but you'll need a solid grasp of cryptocurrency mechanics and security practices. The best part about direct ownership is that you can make transactions any time of day through various cryptocurrency exchanges like KvaPay.

Key Differences in Investment Structure

These investment possibilities have some notable differences:

- Control and Management: Professional managers run ETFs and charge management fees, but this reduces technical complexity. Direct ownership has no ongoing fees but you'll handle all security and transactions yourself.

- Trading Environment: Bitcoin never stops trading in the crypto market. ETF trading happens only during stock exchange hours. Market movements outside regular trading hours can really shake up your investment strategy.

- Security Approach: ETFs rely on institutional custodians with top-notch security protocols. Direct ownership means you're responsible for security measures like hardware wallets and two-factor authentication.

Cost Analysis and Efficiency

Bitcoin investment options' costs and efficiency are vital aspects that deserve our attention. A clear understanding of these elements helps investors make informed decisions that align with their financial goals.

Management Fees vs Transaction Costs

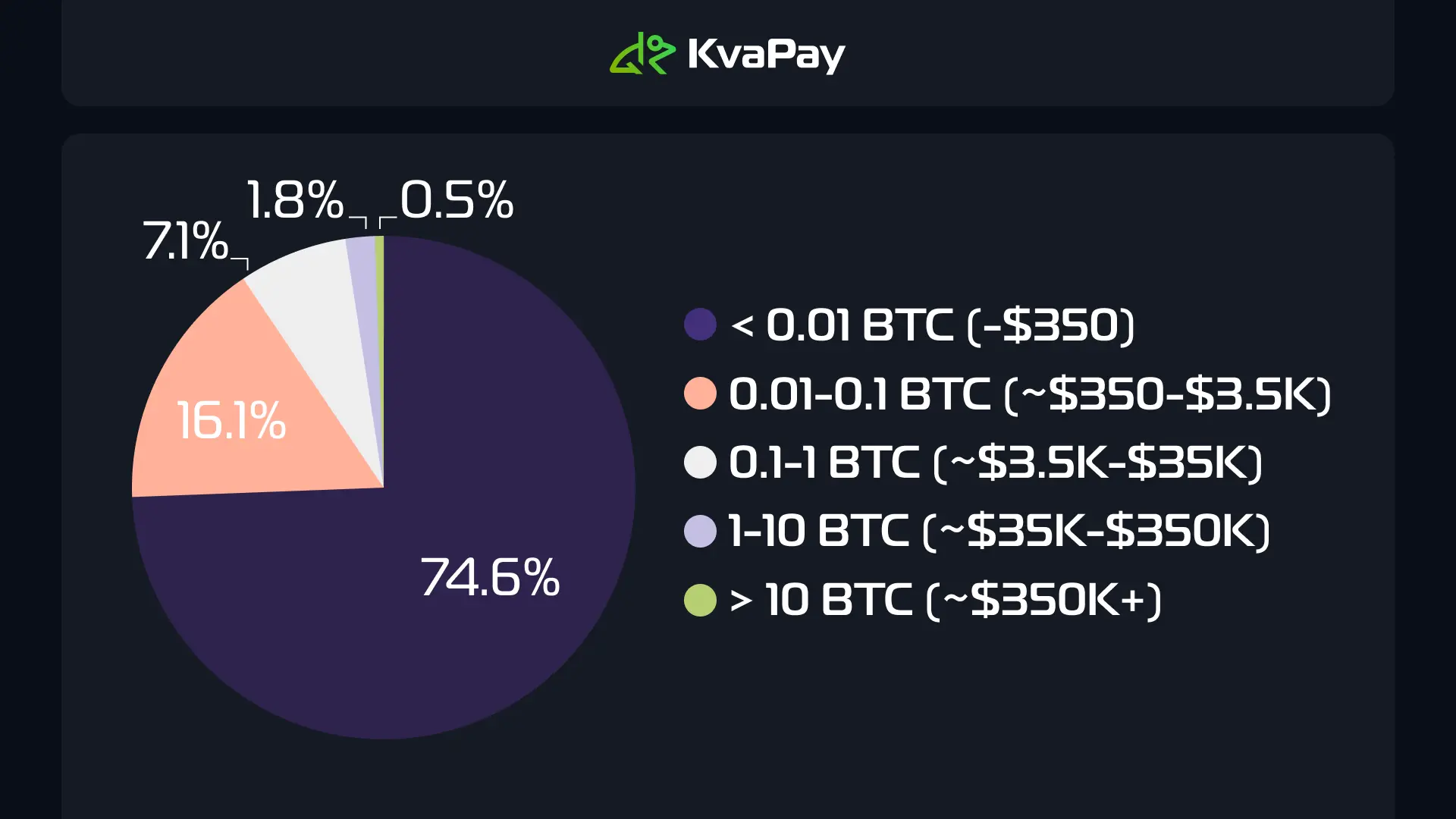

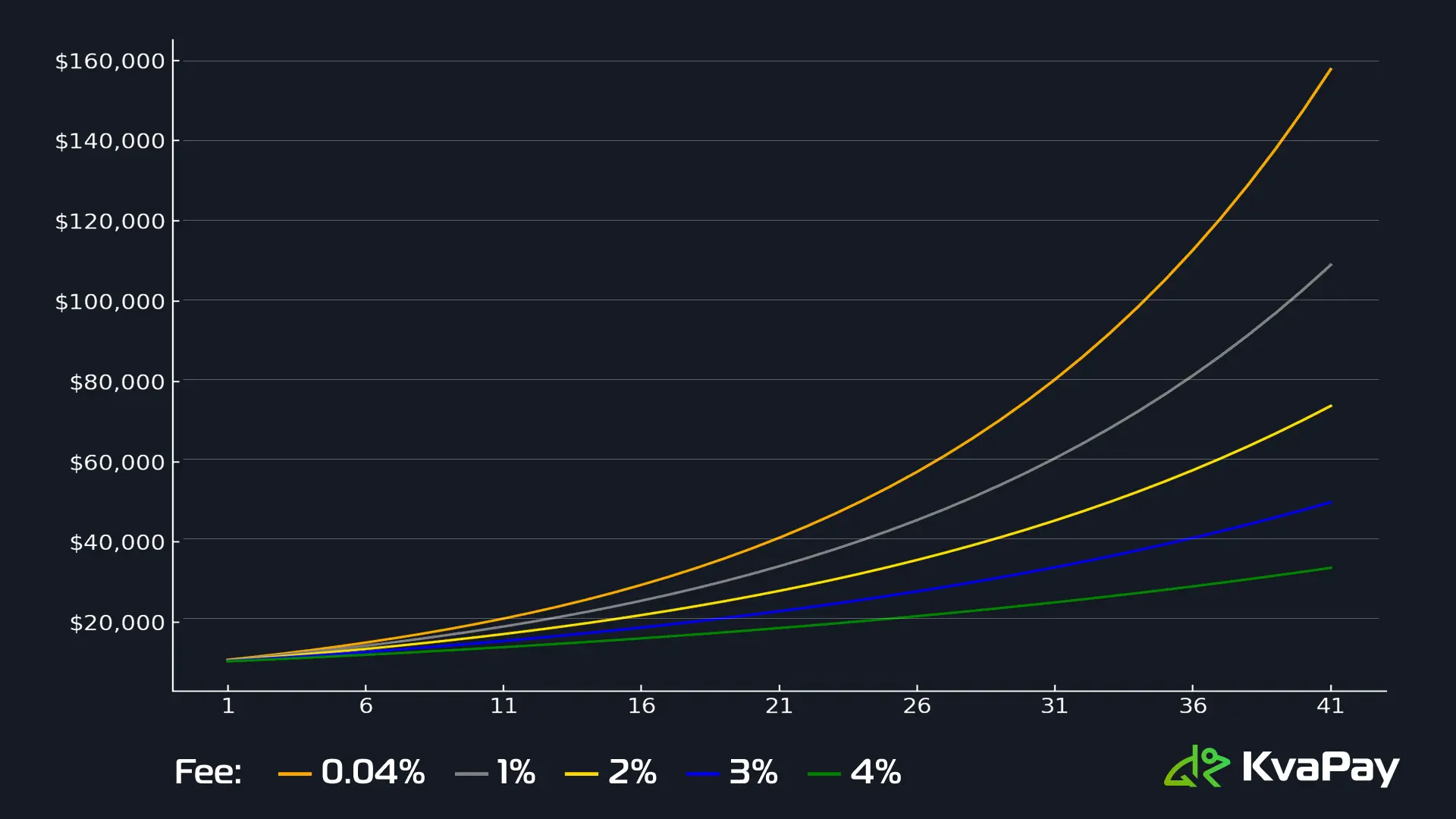

Our exploration of Bitcoin ETFs reveals a wide range of management fees. These fees start from as low as 0.19% for Franklin Templeton to 1.5% for Grayscale [5]. Direct Bitcoin ownership takes a different approach with one-time transaction fees through cryptocurrency exchanges. These fees can be minimal - just a few hundredths of the traded value.

Hidden Expenses in Both Approaches

Both investment methods come with several hidden expenses that affect their overall cost:

- ETFs have some specific costs:

- Custody fees for secure storage

- Trading commissions (though many brokers offer commission-free trades)

- Bid-ask spreads affecting trading costs

- Tracking errors affecting performance (tracking error is a deviation from the price of the underlying asset)

Direct Bitcoin ownership brings its own expenses. These include conversion fees, transfer fees to/from traditional bank accounts, and potential storage solution costs.

Long-term Cost Implications

Fees tend to add up over time. ETF management fees might seem small, but they affect returns year after year. To cite an instance, even minor differences in expense ratios can have a big effect on long-term investment outcomes. This becomes particularly noticeable for investors with longer investment horizons.

The competition between ETF providers has sparked fee reductions, with some offering temporary fee waivers. VanEck stands out by eliminating management fees until March 2025 or until their fund reaches €1.43 billion in assets. This competitive landscape benefits investors, though note that these promotional rates don't last forever.

Security and Risk Assessment

A close look at Bitcoin investment's security landscape reveals distinct safety considerations for both ETFs and direct ownership that deserve our attention.

Custodial Solutions Comparison

Bitcoin ETFs employ institutional-grade custody solutions with advanced security measures like cold storage and multi-signature wallets. Professional custodians often carry criminal insurance coverage to protect ETF holdings. Direct Bitcoin ownership puts you in control of private keys and digital wallets, which gives complete control but needs more responsibility.

Regulatory Protection Measures

ETF providers must follow strict regulatory oversight with regular security audits and compliance checks. The core protective measures include:

- Anti-Money Laundering (AML) protocols

- Know Your Customer (KYC) procedures

- Regular security assessments

- Transparent reporting requirements

Risk Mitigation Strategies

Both investment methods need specific approaches to manage risks effectively. Institutional custodians use complete security frameworks and cryptographic protection for ETFs. People who hold Bitcoin directly should protect their private keys through encryption and secure storage solutions. Both approaches need regular security audits and updates.

The EU's MiCA framework and other regulations have revolutionized the market with standardized rules and improved transparency requirements. ETFs offer regulated protection but come with counterparty risk through third-party custodians. Direct ownership eliminates this risk but needs constant watchfulness in security practices and private key management.

Investment Strategy Integration

Bitcoin's integration into investment portfolios needs careful thought about allocation size, tax implications, and management strategies.

Portfolio Allocation Considerations

Small Bitcoin allocations can substantially change portfolio performance. Research suggests a 5% Bitcoin allocation helps optimize risk-adjusted returns in traditional portfolios. A mere 1% allocation gives the best marginal improvement in portfolio risk-adjusted returns.

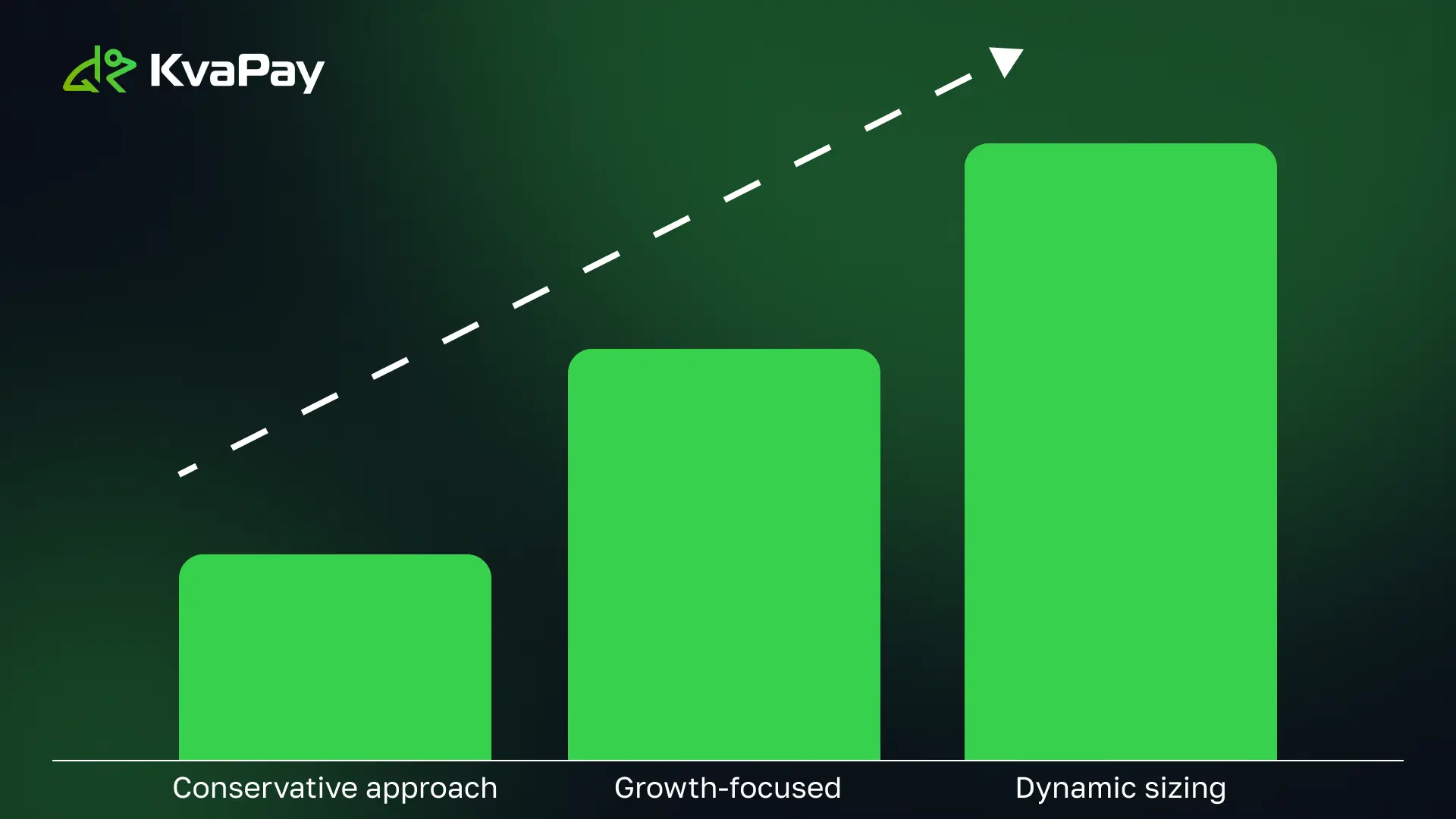

Smart allocation strategies to think over:

- Conservative approach: 2.5-5% allocation with monthly rebalancing

- Growth-focused: Up to 9.5% allocation based on risk tolerance

- Dynamic sizing: Adjustments that match market conditions and correlation changes

Rebalancing and Management Approaches

The best rebalancing frequency depends on portfolio goals. Monthly rebalancing yields the lowest volatility at 10.88% annualized standard deviation. Dynamic rebalancing strategies triggered by threshold breaches have performed better than time-based approaches historically.

Transaction costs and market impact need attention during rebalancing. Calendar-based rebalancing brings predictability through monthly, quarterly, or yearly schedules. Threshold-based rebalancing responds to big market moves. Bitcoin allocations with yearly rebalancing have delivered 143% returns, while quarterly gave 111% and monthly showed 97% returns.

When rebalancing your investment portfolio, however, make sure that both the Bitcoin ETF and the sale of Bitcoin itself are taxed correctly. We recommend consulting a cryptocurrency regulatory and taxation expert before making your first sale or exchange into another coin.

Conclusion

Bitcoin investment options now give investors amazing flexibility through ETFs and direct ownership. We got into how each approach helps different investors through its own advantages. ETFs give regulated, professionally managed exposure. Direct ownership lets investors have complete control and trade any time they want.

Looking deeper shows that costs go beyond simple management fees and transaction charges. ETF costs add up over time through ongoing fees. Direct ownership needs technical knowledge and security management up front. The security setup is different too. ETFs use institutional protection while direct ownership puts the responsibility on the investor.

Portfolio integration plays a key role. Both options can boost risk-adjusted returns when sized and rebalanced properly. Studies show that even small Bitcoin allocations of 1-5% can affect portfolio performance in a big way if managed well.

Your choice between ETF and direct Bitcoin ownership depends on your situation. Investors who just need simplicity and regulatory protection might like ETFs better. Those who want full control and 24/7 market access could go for direct ownership. Both ways work well to get Bitcoin exposure. The key is to understand their features and line them up with your investment goals.