Crypto vs Traditional Banking: Real Advantages & Disadvantages

28 September 2025

6 min for read

While traditional banks serve over 90% of adults worldwide, cryptocurrencies are rapidly gaining ground by offering significantly lower transaction costs - just around 1 % compared to the traditional 3 %. We're seeing remarkable innovations, like Lightning Network processing 1 000 000 transactions per second. Layer-2 Bitcoin solution thus surpasses Visa several times over, which can process 65,000 transactions

However, this race between old and new brings up important questions about security, regulation, and practical usage. In this KvaPay guide, we'll help you understand which system might work better for your financial needs, exploring everything from transaction speeds to regulatory protection.

Understanding Banking Systems in 2025

Traditional banking systems are evolving rapidly in response to technological advancements. Banks now integrate artificial intelligence for customer support and risk management, fundamentally changing their relationship with customers. Additionally, these institutions operate under strict regulatory frameworks, ensuring consumer protection and financial stability. This might be one of the best features.

The banking landscape in 2025 showcases a remarkable shift toward digital transformation. Banks are implementing real-time data visibility and improved risk management through new-generation core systems. Furthermore, approximately 55% of Americans prefer mobile banking applications over traditional computer-based access.

In contrast, cryptocurrency systems operate on fundamentally different principles. These decentralized networks eliminate intermediaries, enabling direct peer-to-peer transactions. The blockchain technology underlying cryptocurrencies provides enhanced security through encryption methods, making transactions nearly impossible to tamper with.

The integration between traditional banking and cryptocurrency systems continues to grow. Major players like PayPal and Visa are incorporating cryptocurrencies into their platforms. Moreover, banks are beginning to offer crypto loan products, allowing customers to borrow against digital assets.

The stablecoin market has reached approximately €213 billion in circulation. These digital assets, backed by fiat currency at a 1-to-1 ratio, are gaining traction for remittances and business-to-business payments. Notably, the European Union has established comprehensive regulatory frameworks through the Markets in Crypto-Assets regulation.

Traditional banks maintain their relevance through established trust mechanisms and comprehensive service offerings. They provide essential services like mortgages, business credit lines, and wealth management that pure crypto solutions currently cannot match. Nevertheless, banks face challenges from rising non-performing loans, particularly in commercial real estate and small enterprises.

Looking ahead, the financial sector is moving toward hybrid institutions that combine traditional banking stability with cryptocurrency innovation. These institutions are developing integrated services such as crypto custody solutions, trading platforms, and blockchain-based settlement systems.

Real-World Impact on Users

Security and transaction efficiency shape the daily experience of users in both banking systems. Bitcoin transactions typically complete within minutes, although network congestion can affect processing times. In comparison, traditional bank transfers through ACH may require 1-3 business days for settlement.

Cost considerations remain a crucial factor for users. Traditional banking systems often impose substantial fees, especially for international transfers, which can reach up to multiple dozens Euro. Credit card processing fees typically range between 1-3% per transaction. Alternatively, cryptocurrency transactions generally offer lower costs, with fees varying based on network activity.

The accessibility landscape differs markedly between these systems. Traditional banks maintain physical branches and ATM networks, yet operate within limited hours. Conversely, cryptocurrency platforms operate continuously, allowing 24/7 access from any location with internet connectivity. Some of our Crypto ATMs also operate 24/7 - see all the available machines on this website.

Security measures in both systems present distinct advantages. Traditional banks employ well-established security protocols, including fraud detection systems and regulatory oversight. These institutions also offer deposit insurance, protecting customer funds up to specified limits. Meanwhile, blockchain technology utilizes advanced cryptographic principles and distributed networks for transaction security. The decentralized architecture enhances cyber resilience through multiple consensus mechanisms.

Risk management varies significantly between systems. Traditional banks face challenges from cyber attacks and data breaches due to their centralized nature. Cryptocurrency users must contend with different risks, primarily related to wallet security and exchange platform reliability. The blockchain's immutable ledger and time-stamped records provide enhanced fraud prevention capabilities.

Recent developments have begun bridging these systems. The OCC (The Office of the Comptroller of the Currency) permits national banks to use public blockchains and stablecoins for payment activities. This regulatory shift places blockchain networks in the same category as traditional payment systems like SWIFT and ACH. Banks can now offer cryptocurrency custody services, helping secure digital assets from theft while providing institutional-grade protection.

The impact on cross-border transactions has been particularly noteworthy. Blockchain technology enables faster and more cost-effective international transfers by eliminating intermediaries. This efficiency gain benefits both individual users and businesses conducting global operations.

Making the Right Choice

Choosing between cryptocurrency and traditional banking requires careful consideration of your financial priorities and risk tolerance. Traditional banking offers stability through regulatory oversight and deposit protection, making it ideal for those seeking established financial services.

For international transactions, cryptocurrency presents compelling advantages. The cost of sending 200 globally through traditional banking can average 3 %, whereas Bitcoin transfers can cost merely 1 % (depending on the validation fees cost). This substantial difference makes crypto particularly attractive for cross-border payments and remittances.

Cryptocurrency stands out for its accessibility and operational efficiency. The system operates continuously, enabling transactions regardless of banking hours or geographical locations. Additionally, the elimination of intermediaries results in faster processing times and reduced fees for international transfers.

Consider these factors when making your choice:

Transaction Requirements

- Traditional Banking: Best for local transactions and established financial services

- Cryptocurrency: Optimal for international transfers and rapid settlements

Security Preferences

- Traditional Banking: Government-backed deposit insurance and regulatory protection

- Cryptocurrency: Blockchain security and decentralized control

Service Accessibility

- Traditional Banking: Physical branches and regulated customer service

- Cryptocurrency: 24/7 access with internet connectivity

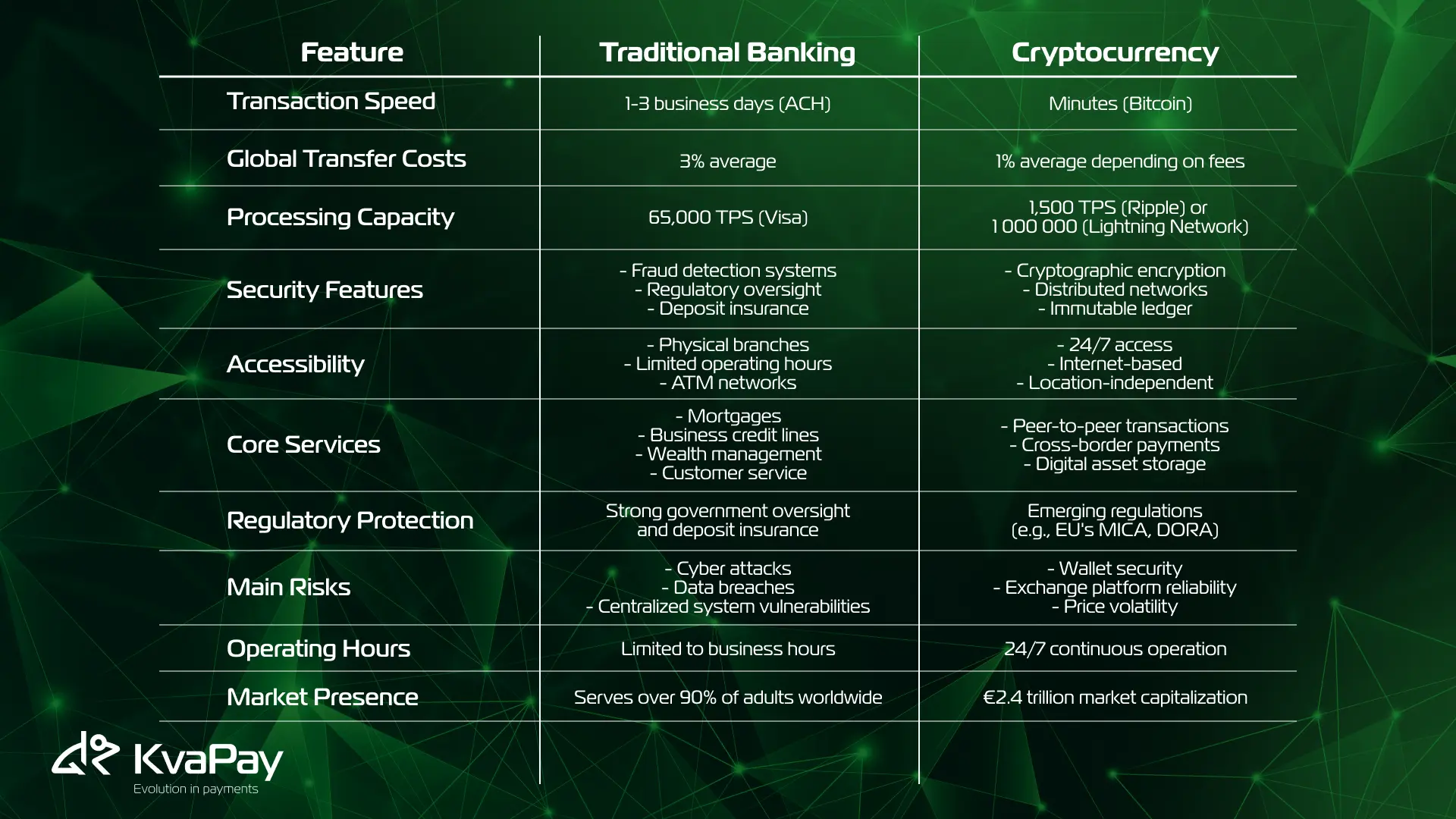

Comparison Table

Conclusion

Traditional banking and cryptocurrency systems each offer distinct advantages that serve different financial needs. While traditional banks excel at providing comprehensive financial services with strong regulatory protection, cryptocurrencies stand out through faster, cheaper international transfers and round-the-clock accessibility.

The data speaks clearly - traditional banks serve over 90% of adults worldwide, offering essential services like mortgages and wealth management. However, cryptocurrencies have grown to a €3.2 trillion market cap by addressing key pain points in global finance, particularly cross-border transactions.

Security considerations differ significantly between these systems. Traditional banks provide government-backed deposit insurance and established fraud protection. Cryptocurrency networks offer innovative security through blockchain technology and distributed systems, though users must carefully manage their private keys and choose reliable exchanges.

Ultimately, your choice between traditional banking and cryptocurrency should align with your specific needs. Consider transaction costs, speed requirements, security preferences, and service accessibility when deciding which system works best for you. The future of finance appears increasingly integrated, offering users the best of both worlds.