MiCA regulation: Everything you need to know to prepare your cryptocurrency business

16 December 2024

8 min for read

Over two years after its initial proposal, the finalized version of the Markets in Crypto-Assets Regulation (MiCA) has been published. MiCA seeks to establish a structured regulatory framework across the EU, focusing on the issuance, management, and trading of crypto-assets. It will introduce licensing requirements, business conduct regulations, and a market abuse framework for crypto-assets.

Under these new rules, crypto platforms are required to adhere to stricter security and operational standards, which lowers the likelihood of hacking incidents or poor management. Additionally, users gain access to clearer information about the assets they are investing in, enabling them to make well-informed choices and reducing the chances of falling victim to scams or fraudulent schemes.

As sections of MiCA did already become effective in a spring 2024, it’s essential for cryptocurrencies and stablecoin issuers, crypto-asset custodians, and other crypto service providers to be aware of its provisions.

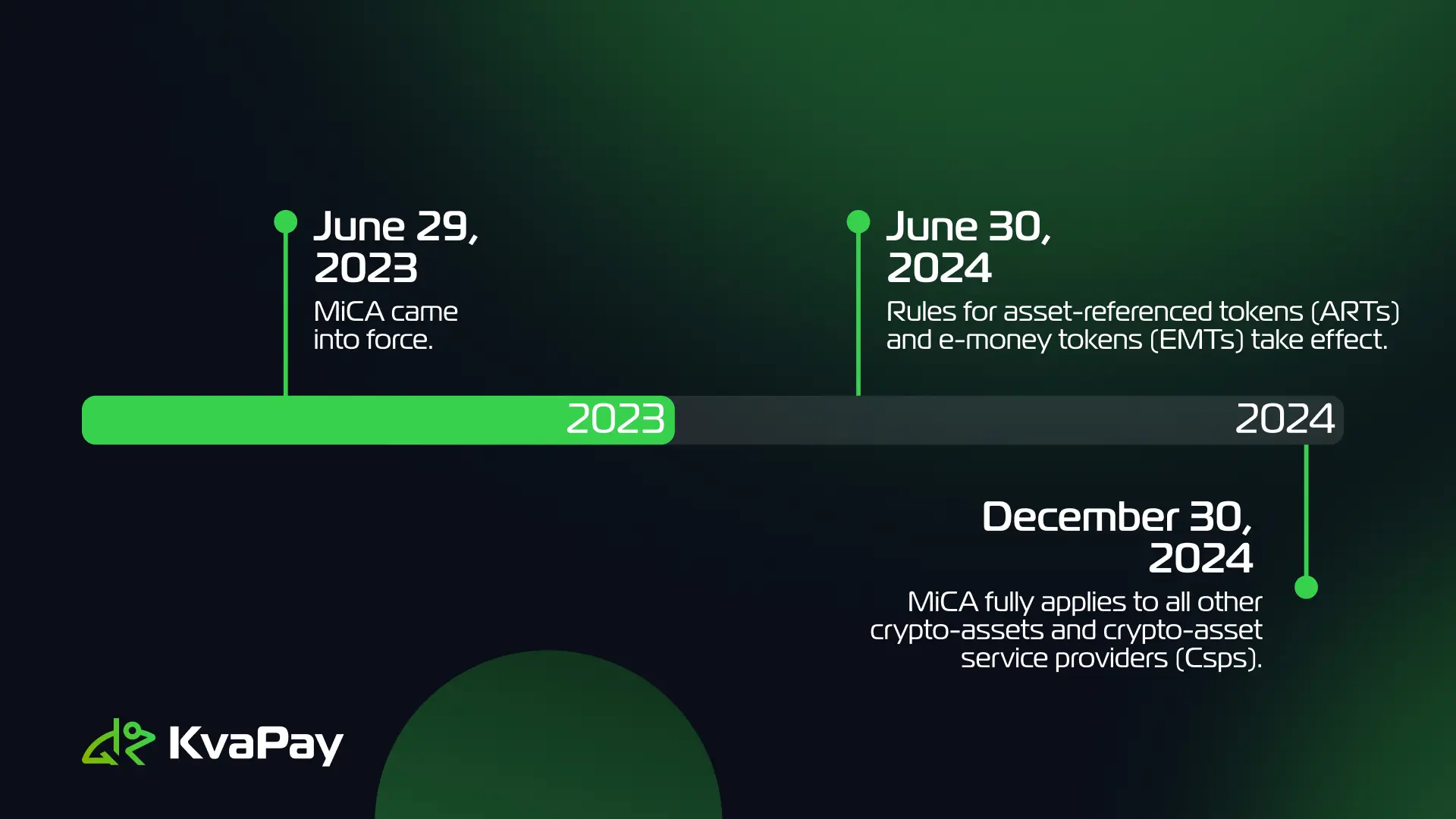

Effective dates and implementation phases for MiCA

- June 29, 2023: MiCA came into force.

- June 30, 2024: Rules for asset-referenced tokens (ARTs) and e-money tokens (EMTs) take effect.

- December 30, 2024: MiCA fully applies to all other crypto-assets and crypto-asset service providers (CASPs).

Learn terms linked to MiCA:

- MiCA: Markets in Crypto-Assets Regulation

- ARTs: Asset-Reference Tokens

- EMTs: E-Money Tokens

- CASPs: Crypto-Asset Service Providers

- dAPPS: decentralized Applications

- DeFi: Decentralized Finance

- NFTs: Non-Fungible Tokens

- CBDCs: Central Bank Digital Currencies/Assets

- MiFID: Markets in Financial Instruments Directives

- ESMA: European Securities and Markets Authority

Which types of assets will MiCA cover?

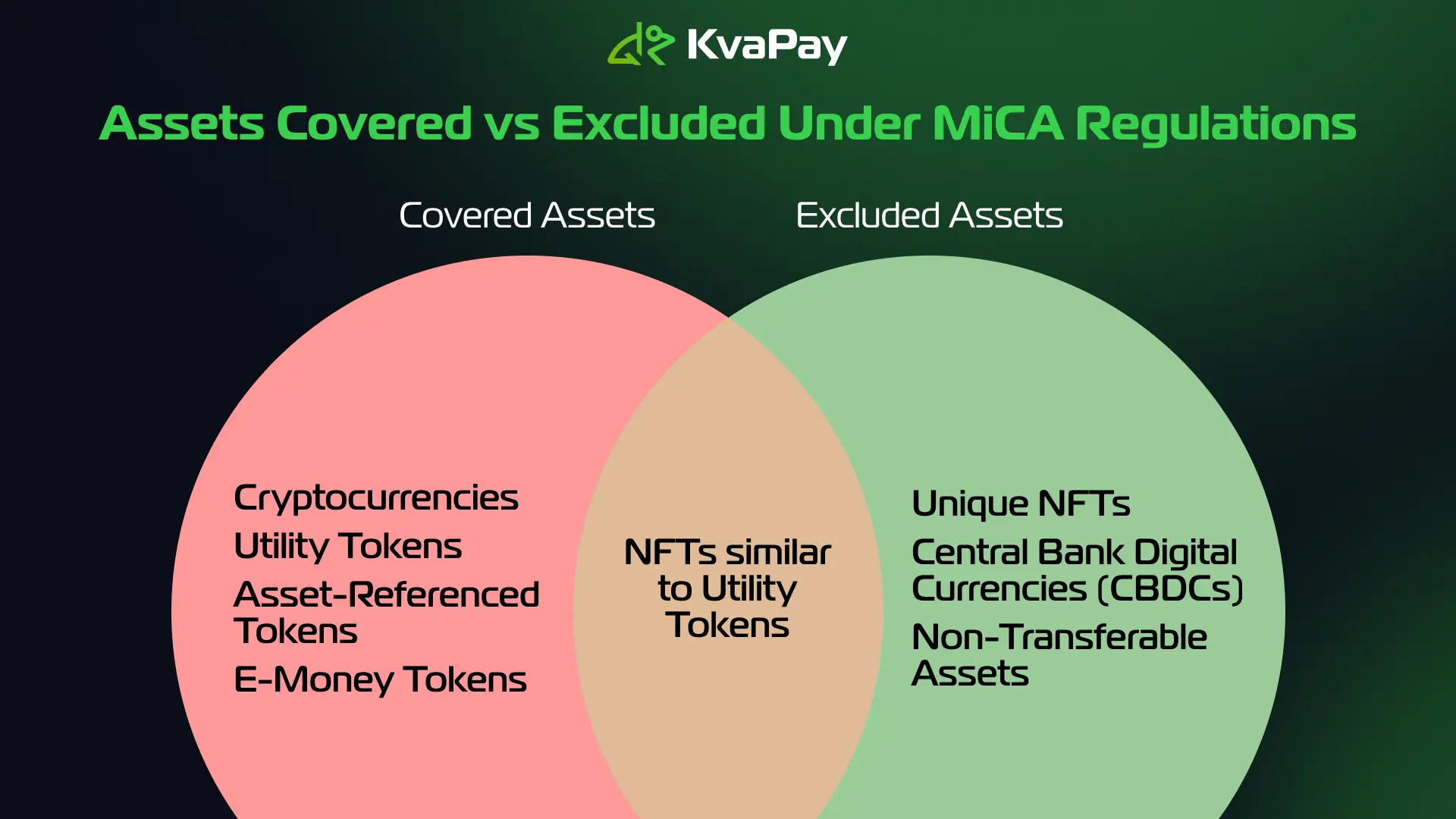

MiCA applies to “crypto-assets,” broadly defined as “digital representations of value or rights secured through cryptography in the form of a coin, token, or any digital medium that can be transferred and stored electronically via distributed ledger or similar technology.” This includes cryptocurrencies like Bitcoin and Ethereum, as well as stablecoins and utility tokens.

MiCA will thus cover four primary types of assets:

- Cryptocurrencies - Most cryptocurrencies like Bitcoin, Ethereum, and other widely traded tokens.

- Asset-referenced tokens (ARTs) - Stablecoins backed by commodities or multiple currencies.

- E-money tokens (EMTs) - Stablecoins backed by a single fiat currency.

- Other tokens, including utility tokens - For example, tokens offering a specific utility or access.

Assets excluded from MiCA regulations

Some NFTs and Unique Assets: MiCA does not apply to crypto-assets that are unique and non-fungible with other crypto-assets, such as digital artwork or collectibles valued for their unique attributes. It also does not cover assets that represent specific services or unique physical assets, like real estate. NFTs must genuinely meet “unique and non fungible” criteria beyond simply having a unique identifier.

Competent authorities should use a “substance over form” approach when classifying assets, focusing on the asset’s actual characteristics rather than its issuer’s designation. While MiCA doesn’t typically apply to non-fungible tokens (NFTs), it may regulate NFTs that exhibit characteristics similar to utility tokens or financial instruments. Importantly, simply assigning a unique identifier to a token does not inherently classify it as non-fungible under MiCA. NFTs issued in large series could be deemed fungible, thus subject to MiCA’s authorization requirements, which may particularly impact NFT projects involving fractionalization.

- Central Bank Issued Assets (CBDCs): Digital assets issued by central banks in their official monetary role, along with other assets issued by authorities, are also exempt from MiCA.

- Non-transferable Assets: MiCA excludes assets limited to use by the issuer, which cannot be transferred between holders. Loyalty programs where points are redeemable only with the issuer are examples of such assets.

Does MiCA regulate DeFi applications?

No, MiCA does not apply to decentralized applications (dApps) that operate without intermediaries. As DeFi is a subset of dApps, it also remains outside MiCA’s scope. For guidance on structuring dApps legally, explore best practices.

Scope of MiCA Compliance: Is your crypto business obliged to MiCA?

Under MiCA, the regulation applies to various crypto-asset service providers, including:

- Custodial wallet providers (e.g. Coinbase, Binance, Gemini)

- Crypto exchanges for both crypto-to-crypto and crypto-to-fiat transactions (e.g. Kraken, KuCoin)

- Crypto trading platforms (e.g. OKX, Robinhood)

- Crypto brokers (e.g. eToro, CEX, AvaTrade)

- Firms providing crypto advisory or portfolio management services (e.g. PixelPlex, CryptoConsultz)

- Crypto launchpads (e.g. Seedify, Binance Launchpad, Polkastarter Ltd.)

Why crypto businesses must comply with MiCA?

MiCA defines CASPs as any individual or business that provides professional crypto-asset services to others, including:

- Holding and managing crypto-assets on behalf of third parties

- Operating a crypto-asset trading platform

- Converting crypto-assets to fiat currency

- Exchanging one crypto-asset for another

- Executing crypto-asset orders for third parties

- Placing crypto-assets in the market

- Receiving and transmitting orders for crypto-assets

- Offering crypto-asset advisory services

Thus, businesses providing these services are required to comply with MiCA.

Does my firm need a license for crypto-asset services?

Generally, yes, being a CASP company requires authorization. However, credit institutions and MiFID-licensed investment firms are allowed to offer crypto-asset services without additional authorization, though they must notify relevant authorities. These firms must still adhere to MiCA’s supervisory framework, business conduct rules, and governance standards.

Specific requirements for crypto businesses

CASPs under MiCA must:

- Be established within the EU, with part of their crypto-asset services based in that country. 2. Maintain effective management within the EU.

- Have at least one director residing in the EU.

- Consistently meet conditions for their authorization.

- Operate crypto-asset services across the EU, either through establishment rights, including branch offices, or through service provision rights, even without a physical presence in each host country.

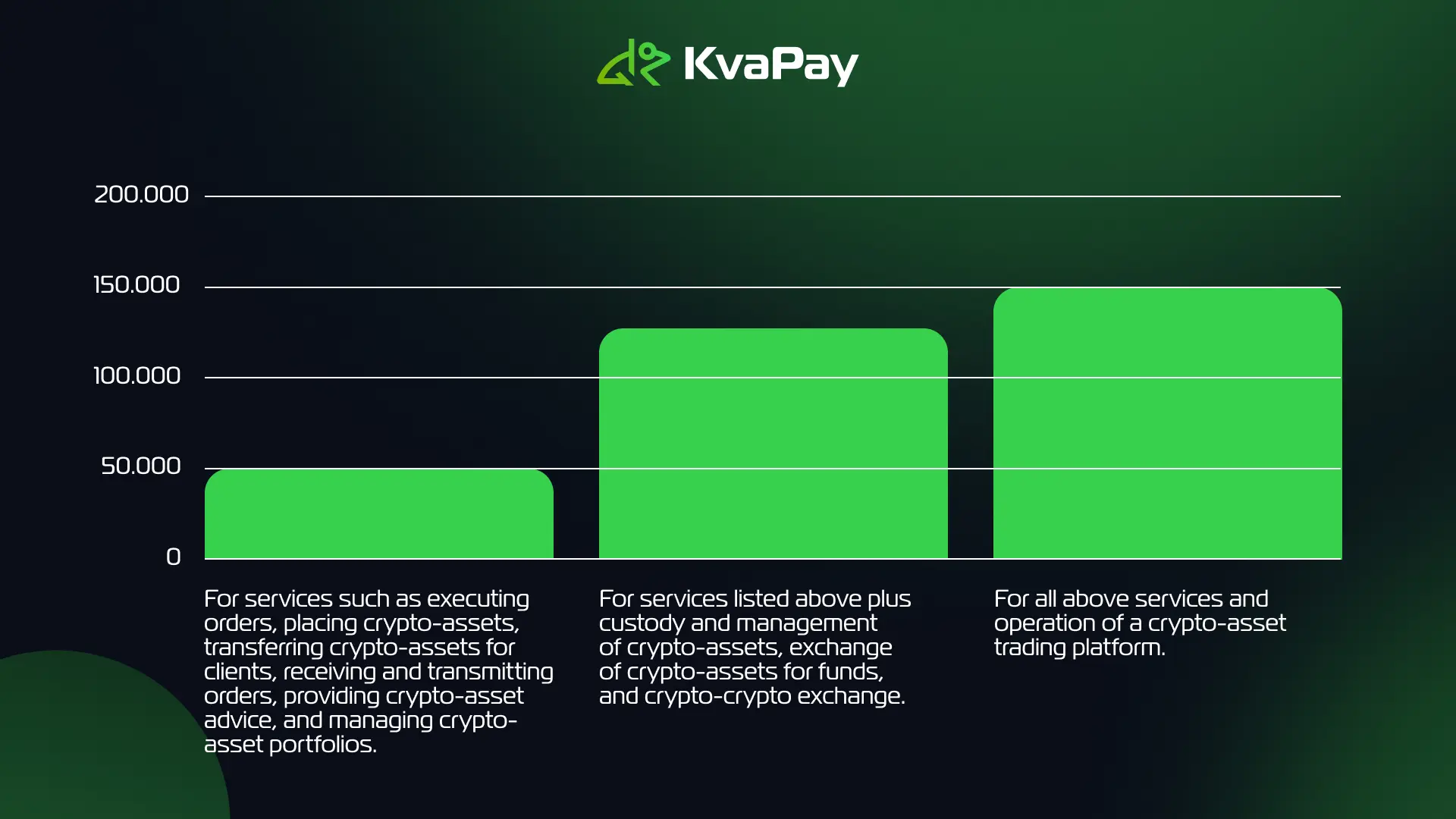

Capital requirements based on services provided

- €50,000 for services such as executing orders, placing crypto-assets, transferring crypto assets for clients, receiving and transmitting orders, providing crypto-asset advice, and managing crypto-asset portfolios.

- €125,000 for services listed above plus custody and management of crypto-assets, exchange of crypto-assets for funds, and crypto-crypto exchange.

- €150,000 for all above services and operation of a crypto-asset trading platform.

Necessary steps for businesses licensing under MiCA

- Select the legal structure and EU member state location for your CASP. 2. Submit an authorization application with the relevant national authority, detailing identification, ownership, policies, systems, security, and complaint handling as per Article 62 of MiCA.

- The authority will review for completeness within 25 working days and request any missing information.

- After completion, the authority will decide on the application within 40 business days, granting or refusing authorization with reasons.

- Once authorized, CASPs must consistently adhere to authorization conditions, including capital, governance, resilience, and other regulatory requirements.

- Draft orderly wind-down plans and ensure appropriate policies for custody, trading, exchange, and placement.

- Submit a request to the competent authority to expand services or to offer cross-border services in other EU member states.

- Designate a compliance officer to submit annual reports and maintain regulatory contact with competent authorities and the European Securities and Markets Authority (ESMA).

The ESMA and national authorities will monitor and enforce compliance with MiCA, with powers to conduct inspections, request information, and impose penalties for violations.

In conclusion, MiCA represents a major step towards establishing a clear and reliable regulatory landscape for crypto-assets in the EU. Its implementation is expected to build trust in crypto assets, promoting their broader acceptance in the economy.

Don't underestimate the implementation of MiCA regulations into your cryptocurrency business. If you are hesitant about your competency, reach out to relevant companies that know the specific requirements for your country in Europe.

Disclaimer: This article is intended as an informational resource and should not be taken as an instruction manual for proper MiCA implementation. We take no responsibility for your person's misuse of the information provided.

Tags:

Share: