Cryptocurrency trading is a favorite side hustle for many people. For some, even the primary source of income. There are many ways of trading crypto, from HODLing (long-term investment) to short-term (intraday) strategies. This article will tell you how to earn profits on small price movements, ideally within one day.

What is short-term trading?

Trading for short-term gains has many names: swing trading, a strategy that involves positions from several minutes to a few days, or intraday trading, which refers to trading within one day. This type of trading aims to profit from short-term price fluctuations, not long-term holding. This approach demands a lot of concentration, knowledge of technical analysis, and discipline.

The appeal of short-term crypto trading

Volatility as opportunity

In our previous articles, we repeatedly mentioned that volatility poses great risks but also great rewards. It’s time to discuss the latter more.

The cryptocurrency market is notorious for its high volatility, shifting prices dramatically within hours. Unlike in traditional financial markets, crypto is traded 24/7, which makes short-term cryptocurrency trading accessible regardless of your time zone or schedule. Thanks to volatility, there are always opportunities.

Accessibility and liquidity

Cryptocurrency exchanges are accessible to anyone with an internet connection. The market's liquidity, especially for currencies like Bitcoin and Ethereum, ensures that any trader from all over the world can open and close positions in the blink of an eye—an essential factor for short-term trading.

Diversity of trading instruments

Trading crypto means accessing a wide range of trading pairs, both crypto-crypto and crypto-fiat. This diversity enhances the traders’ potential to profit from the price difference of many assets.

Key strategies for short-term crypto trading

Day trading

Often called intraday trading, this strategy involves buying and selling within the same day, with positions often lasting up to several hours. The goal of this type of trading is to take advantage of minor price movements. Intraday traders often use technical analysis, candlestick charts, indicators, and patterns to identify their price targets.

Tools for day trading you can use:

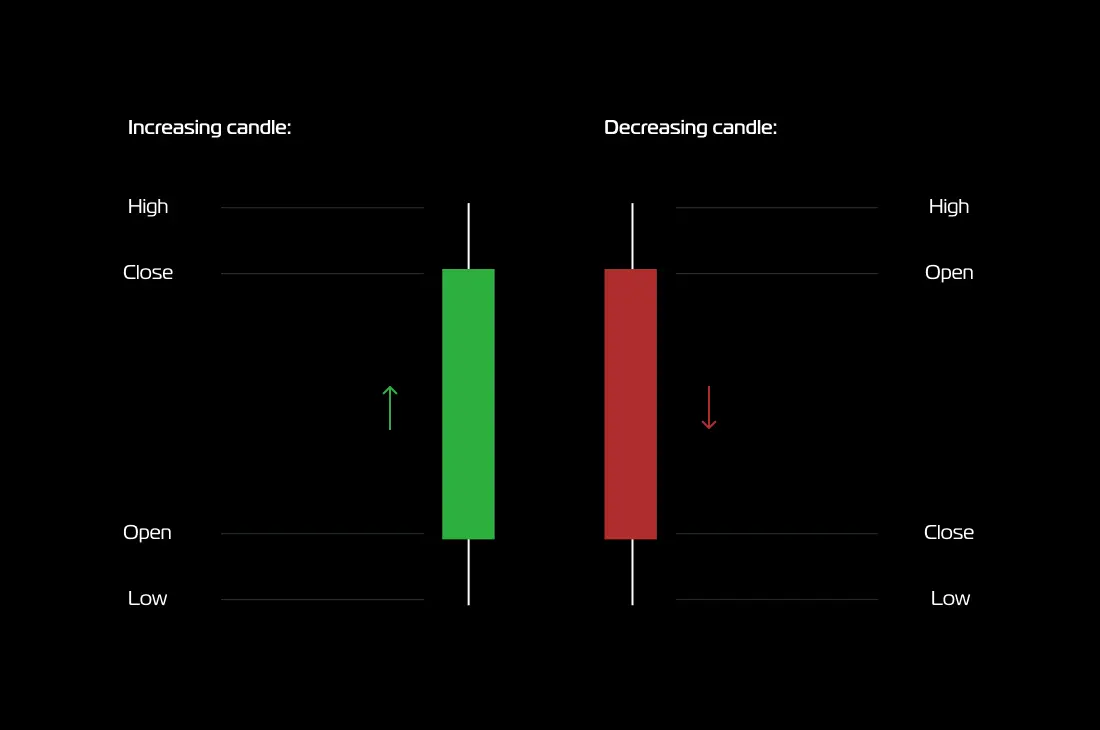

Candlestick charts: Visual representation of price movement within a specific timeframe. Gives a better understanding of the asset’s trend.

Here is a graph to show you how it works:

Moving averages: A standard technical indicator usually available in a trading terminal. It smoothens the price data, helping you identify trends and potential trend reverses.

Relative strength index (RSI): This is another technical indicator, a momentum oscillator showing the price change's speed. It shows oversold or overbought conditions.

Scalping

Scalping is a type of day trading in which traders make many more trades, sometimes even hundreds. This strategy aims to profit from price movements that are even smaller than in regular day trading. Scalpers strive for liquidity and speed, opening and closing positions very quickly. They often use marginal trading to increase their yield from small price shifts.

Toolset for scalping:

Order book analysis: Observation of buy and sell orders balance can help predict the upcoming price trend.

Volume indicators: High trading volume signals strong price moves, which is an excellent opportunity for scalping.

Bot trading: Using the indicators above, you can create an automated trading algorithm that will execute a scalping strategy much faster than you as a human could.

Swing trading

Swing traders take advantage of broader price moves and market trends than day traders. This strategy implies holding positions for several days, usually not more than a month, to benefit from the price swings between market cycles.

Tools useful for swing trading:

Fibonacci retracement: A tool that points to potential reversal levels by measuring a price movement's peak and bottom.

Bollinger bands: Indicators measuring volatility. They help you grasp current overbought or oversold conditions and understand entry and exit points.

Resistance and support levels: Horizontal lines on the chart show the historic levels past which the price was reluctant to move. A support level is the bottom border, and resistance is the top border.

Momentum trading

Momentum trading implies buying when there is a strong and stable trend and then selling when the trend shows signs of weakening. The underlying idea here is that the assets in motion stay in motion.

Tools for this strategy:

MACD (moving averages convergence divergence): This indicator shows changes in momentum by comparing moving averages.

Trend lines: Diagonal lines that you need to draw on a chart to connect the subsequent highs and lows to visualize the direction of the trend.

Volume-weighted average price (VWAP): A benchmark that shows the average price the asset has had throughout a day, based on its price and volume.

Risks of short-term trading you should know about

Volatility

While it does create opportunities, the downside is that it brings equal risks. The trend can reverse in seconds and lead to a significant loss, especially if you are not glued to the screen with the chart, which brings us to the next problem.

Emotional stress

Short-term trading demands a lot of attention. Be ready always to keep your finger on the pulse to know when to open and close the position. Such a need to control is emotionally exhausting. The nature of the strategies described above can provoke excitement and lead to impulsive decisions that are a hazard when it comes to risky trading strategies.

Technical failures

This attention-demanding kind of trading requires an always-stable internet connection, a never-failing computer, and a reliable trading terminal. Anything that lags, crashes, or randomly disconnects will cause you to lose money.

Regulatory risk

Remember to check the regulatory environment for cryptocurrency trading in your country. Check if you must pay capital gains tax and decide beforehand how to file the tax report. Some countries don’t require paying taxes when capital gains fall below a specific volume.

Tips for short-term crypto trading success

Plan your trading

A well-thought-out trading plan should include your goals, risk tolerance, strategies, and rules for entering and exiting positions. Follow your plan and stay practical. Don’t let your emotional passion lead you into a trading fever.

Use risk-management tools

Stop-loss and take-profit orders are essential tools that cover your back. Using them helps you stay confident and reduces the need to control the chart as carefully. Never risk more than you can afford to lose.

Stay informed

Many forces influence the crypto market. Although some are pretty invisible, it is in your power to increase your awareness of the known factors. Find your favorite news media and conveniently keep track of market news.

Practice with demo accounts

Many platforms offer a demo account feature that allows you to practice your trading skills without risking real money. With all the dynamic trading strategies described, it is essential to have a solid understanding of what you are doing supported by some practice.

To conclude this topic, we must advise you to value your comfort in trading above all. If you feel pressured by the rapid pace of scalping or anxiously uncertain how long the trend will remain in momentum trading strategy, you may be more of a long-term crypto holding person. In any case, there is always a strategy that fits your personality and risk tolerance.

Tags:

Share: