What Banks Rarely Explain About Cryptocurrency Payments

01 February 2026

5 min for read

Traditional banking systems generally cannot support such tiny payments because fixed transaction fees make them impractical.

In recent years, digital payments have been evolving through cryptocurrency microtransactions, particularly where specialized networks are used. These solutions make it possible for users to pay small amounts for individual articles, streams, or digital services, addressing a long-standing issue in finance: the inefficiency of low-value payments within traditional banking systems.

In this article, we explore how selected cryptocurrency payment solutions are influencing digital transactions (from lowering cross-border payment friction to supporting new usage-based business models) and what is often left out of conventional banking narratives.

The Hidden Costs Banks Rarely Highlight

Banks typically do not emphasize the full cost structure behind sending or receiving money. These costs can significantly affect individuals and businesses, especially when dealing with smaller payments.

When currency conversion is involved, exchange rate markups of 2–4% are common, effectively embedding fees into unfavorable rates. Even domestic transfers may include account maintenance fees or intermediary charges.

When transactions pass through multiple correspondent banks, each intermediary may deduct its own fee, further reducing the final amount received. For businesses handling frequent payments, these cumulative costs can become a noticeable burden.

These limitations help explain why cryptocurrency microtransactions — in certain networks and payment layers — have gained attention. Unlike traditional banking, where fees often exceed the value of small payments, some crypto-based solutions enable much lower relative transaction costs, making micropayments economically feasible again.

How Cryptocurrency Microtransactions Are Changing Digital Payments

Micropayments have long been difficult to implement because transaction fees often outweigh the payment itself. Selected blockchain networks and second-layer solutions were designed specifically to address this challenge.

Businesses that accept cryptocurrency payments via these networks may benefit from lower transaction costs, sometimes well below those of traditional card processors. However, this depends on the network and payment method used — not all cryptocurrencies offer the same efficiency.

Beyond cost considerations, these payment models introduce several practical advantages:

- Reduced exposure to chargebacks – Transactions are typically irreversible, which can lower fraud-related losses.

- Cross-border simplicity – Payments can be sent globally without navigating multiple banking intermediaries.

- Faster settlement – Some solutions allow near-instant transaction confirmation.

- Pay-per-use models – Users can pay for individual pieces of content instead of committing to full subscriptions.

Layer-2 technologies such as the Lightning Network play an important role here. By handling transactions off-chain and settling them later on the base layer, these systems enable fast, low-fee payments while keeping the underlying blockchain secure.

From Industry Challenges to KvaPay

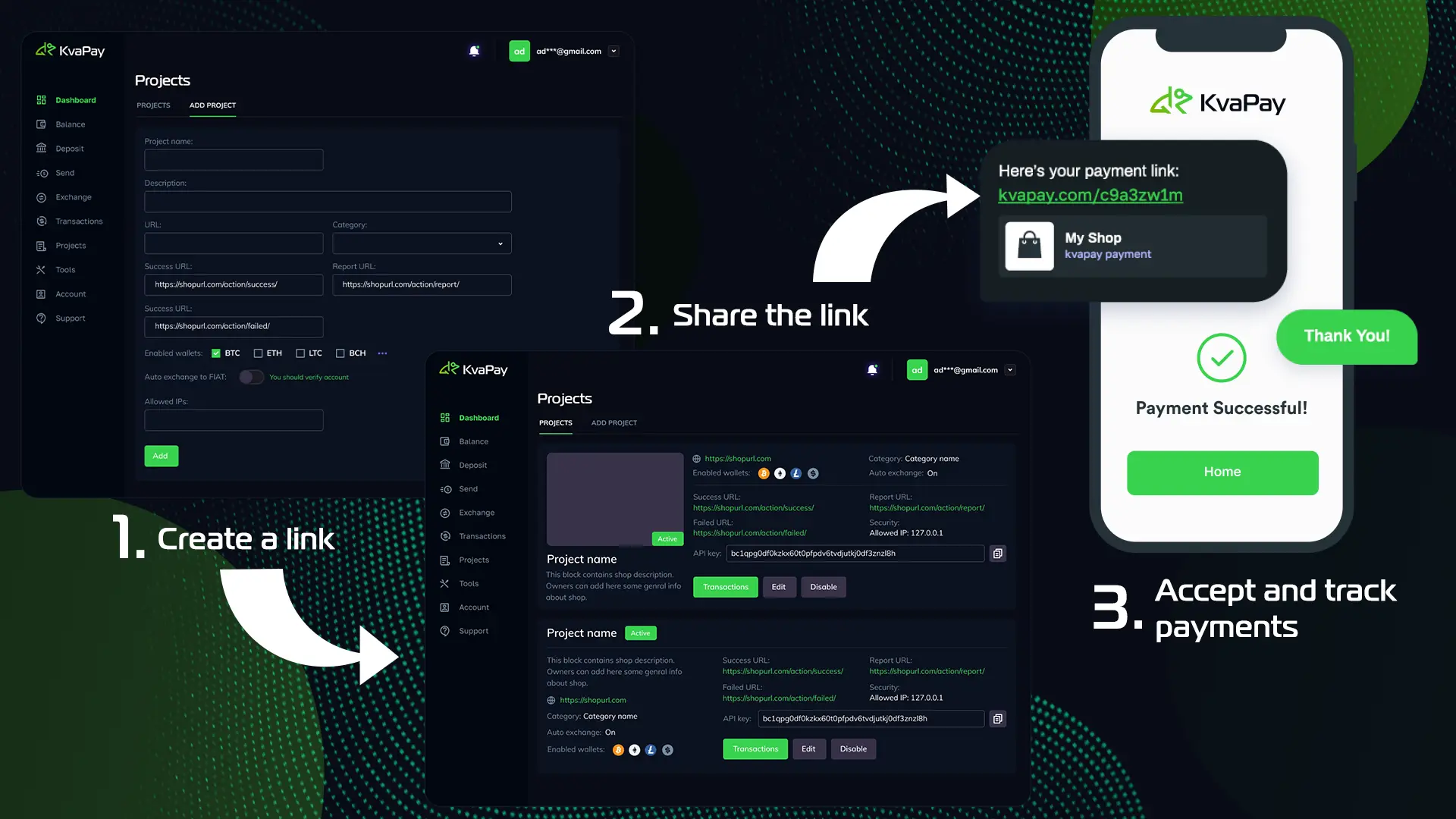

Despite these advances, many businesses still face complexity when integrating crypto payments — from volatility concerns to accounting and user experience. This is where platforms like KvaPay aim to bridge the gap.

KvaPay allows creators and businesses to accept cryptocurrency through Payment Links, with automatic conversion to fiat currencies. This approach simplifies payouts, reduces operational friction, and makes modern payment infrastructure more accessible without requiring deep technical knowledge.

Security and Privacy Considerations in Cryptocurrency Payments

Security is a key concern in digital payments, and cryptocurrency systems rely on cryptographic techniques to protect transaction data from unauthorized access. Distributed ledger architectures reduce single points of failure and make unauthorized manipulation difficult.

Consensus mechanisms such as Proof of Work or Proof of Stake help validate transactions and prevent double spending. For merchants, transaction finality can reduce losses associated with chargeback fraud.

Privacy is another frequently discussed aspect. Some cryptocurrencies are designed with enhanced confidentiality features, allowing users to transact without exposing unnecessary personal information. This can reduce the risk of identity theft and limit the amount of sensitive data shared during payments.

Businesses may also benefit from greater transaction discretion, as public disclosure of sensitive financial activity can sometimes be minimized depending on the solution used. Additional safeguards, such as multi-signature wallets, add further layers of protection.

Biometric authentication — where available — is typically implemented at the wallet or device level, not as a standard feature of cryptocurrency itself. When supported, it can strengthen access control by ensuring only authorized users can initiate transactions.

Overall, by combining encryption, decentralized infrastructure, and optional advanced authentication methods, cryptocurrency payments can offer a robust security framework when implemented responsibly.

Conclusion

Traditional banking systems often obscure the true cost of transactions, particularly for small or cross-border payments. In contrast, specific cryptocurrency networks and second-layer solutions demonstrate how low-value payments can be handled more efficiently.

These technologies enable new monetization options for creators, reduce payment friction for businesses, and offer users faster settlement with fewer intermediaries. While not every crypto network provides the same benefits, the right combination of tools can meaningfully improve digital payment experiences.

As adoption continues to evolve, cryptocurrency payments — when used thoughtfully and with appropriate infrastructure — are becoming a practical complement to existing financial systems rather than a replacement for them.