In this guide, we'll explore how CBDCs could fundamentally transform the cryptocurrency landscape, examining their potential impact on Bitcoin, stablecoins, and the future of decentralized finance.

What CBDCs Mean for the Future of Money

Money has evolved significantly since the introduction of computer technology in the late twentieth century. Initially, by 1990, all money transferred between central banks and commercial banks in the United States existed in electronic form. Subsequently, by the 2000s, most currency had already transformed into digital entries in bank databases.

The rise of digital currencies

The landscape of digital money underwent a fundamental shift with the emergence of tokenization. This innovative approach, primarily through blockchain technology, laid the groundwork for cryptocurrencies, stablecoins, and eventually, CBDCs. Bitcoin's introduction in 2008 marked the first widespread use of decentralized, peer-to-peer cryptocurrency based on distributed ledger technology.

Furthermore, the concept of programmable money has gained significant traction. CBDCs represent a sophisticated form of programmable currency where specific rules can be embedded within the definition of money itself, enabling automated payments between multiple parties. Additionally, this technology offers substantial benefits, including reduced cash management costs for governments and improved financial inclusion through safe money accounts at central banks.

How CBDCs differ from crypto

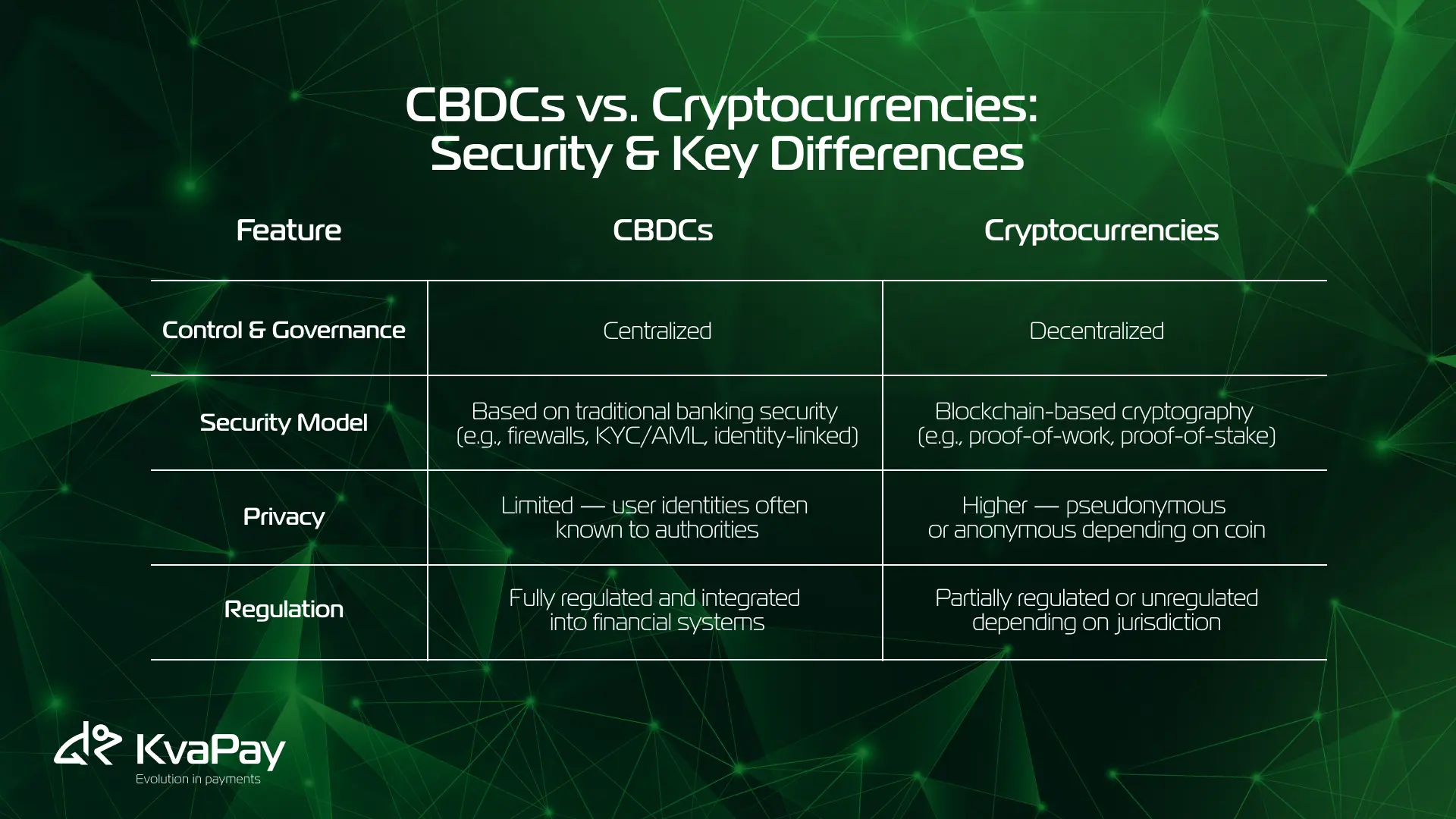

While both CBDCs and cryptocurrencies utilize blockchain technology, they differ fundamentally in several key aspects. Primarily, CBDCs are direct liabilities of central banks, similar to physical currency. This characteristic distinguishes them from cryptocurrencies and stablecoins, which operate without government backing.

Central banks can implement CBDCs in two distinct models:

- Wholesale CBDCs: Limited to commercial banks and clearing institutions, these are more prevalent in advanced economies with developed interbank systems.

- Retail CBDCs: Accessible to businesses and general consumers, these are more common in emerging economies focusing on financial inclusion.

Moreover, CBDCs offer enhanced security features and regulatory oversight. Through cryptographic verification, ownership transfers can be securely executed and verified. This capability, coupled with the central bank's ability to track every unit of currency, significantly strengthens efforts against tax evasion and financial crime.

Looking ahead, experts anticipate a diverse monetary ecosystem where CBDCs, stablecoins, and cryptocurrencies coexist alongside traditional digital and physical currencies. Most countries are currently prioritizing wholesale CBDCs as their initial step, considering the potentially higher risks associated with retail versions. Nevertheless, ongoing research and pilot programs suggest that safe and efficient retail CBDCs will eventually become available.

Why Central Banks Are Racing to Launch CBDCs

The rapid advancement of digital payment technologies has prompted central banks worldwide to accelerate their CBDC initiatives. Currently, 87 countries, representing over 90% of global GDP, are actively exploring these digital currencies.

Control over digital payments

Central banks recognize CBDCs as a strategic response to maintain their role in an increasingly digital economy. Through CBDCs, they aim to preserve control over monetary policy although offering a digital alternative that matches modern payment needs. This approach helps central banks safeguard their position against the growing influence of private payment providers, particularly in small and open economies.

Fighting crypto adoption

One primary motivation behind CBDC development is to counter the potential threats posed by private cryptocurrencies and stablecoins. Rather than creating competing units of account, central banks are designing CBDCs that work alongside existing currencies. This strategy helps prevent what experts call "digital dollarization" - where significant portions of the public might switch to payment products not denominated in their sovereign currency.

Improving payment systems

Central banks are particularly focused on enhancing cross-border payment efficiency through CBDCs. The current system faces several challenges:

- High fees and slow processing times for international remittances

- Limited interoperability between domestic payment systems

- Complex intermediation chains in correspondent banking

To address these issues, central banks are exploring two primary approaches:

- Making retail CBDCs available internationally without specific coordination

- Establishing coordinated multi-CBDC arrangements through central bank cooperation

Recent projects demonstrate promising results. Project Jura, a collaboration between France and Switzerland, showed that CBDCs could facilitate more efficient foreign exchange transactions with reduced counterparty risk. Similarly, Project Dunbar, involving multiple Asian central banks, confirmed the technical feasibility of a unified multi-CBDC platform for cross-border payments.

Beyond efficiency gains, CBDCs offer central banks enhanced capabilities in payment system oversight. They provide better tools for maintaining payment system integrity although ensuring competitive market conditions. This approach allows central banks to promote innovation although maintaining their fundamental role as guardians of monetary stability.

How CBDCs Will Impact Crypto Markets

Recent studies reveal fascinating correlations between CBDC developments and cryptocurrency markets. Research spanning from 2017 to 2022 demonstrates that CBDC-related news and events significantly influence Bitcoin returns.

Effect on Bitcoin price

CBDC uncertainty and attention indices show a positive relationship with Bitcoin returns. Specifically, positive CBDC announcements have triggered notable Bitcoin price movements, indicating that investor expectations about cryptocurrencies are shaped by CBDC developments. These effects became especially pronounced during the COVID-19 pandemic, when CBDC-related news accounted for substantial variations in cryptocurrency market uncertainty.

Stablecoin competition

The battle between CBDCs and stablecoins intensifies as major financial institutions enter the space. During 2023, several significant developments occurred:

- Société Générale launched EUR CoinVertible for on-chain securities settlement

- PayPal introduced PYUSD

- Visa expanded its stablecoin settlement capabilities with USD Coin

Presently, regulatory perspectives on stablecoins vary significantly between regions. The United States supports dollar-backed stablecoins, viewing them as tools to strengthen the dollar's global reserve status. Leading US lawmakers believe expanded stablecoin adoption would help extend the dollar's position internationally.

Conversely, European authorities promote CBDCs, specifically the digital euro, as a mechanism for achieving strategic and economic autonomy from the US dollar. The EU's Markets in Crypto Assets (MiCA) framework imposes bank-like regulatory requirements on crypto asset issuers, potentially creating barriers for non-EU stablecoin providers.

Looking forward, a hybrid future appears likely. Both CBDCs and stablecoins could serve distinct financial needs. CBDCs offer unprecedented transaction visibility and government backing, whereas stablecoins continue driving innovation in cross-border payments and decentralized finance.

The Coming Battle Between CBDCs and Crypto

Privacy stands at the forefront of the emerging battle between CBDCs and cryptocurrencies. A recent survey revealed that enhanced privacy features could boost CBDC adoption by up to 60%. Notwithstanding, central banks face a delicate balance between transaction privacy and regulatory oversight.

Privacy concerns

Different regions exhibit varying approaches to privacy protection. In Cambodia, institutions manage user data separately for transaction privacy, yet China's system records every transaction detail. Japan maintains stricter privacy standards, with commercial banks handling nodes independently, unable to access other institutions' user data.

Adoption challenges

Digital literacy poses a significant hurdle for CBDC implementation. Studies indicate slow adoption rates in certain regions, exemplified by the Sand Dollar's 7.9% uptake in the Bahamas. Additionally, users often struggle to differentiate CBDCs from existing payment systems like debit cards and digital transfers.

User preferences

Consumer behavior patterns highlight interesting trends in digital currency preferences. In China, over 96% of low-amount retail transactions already occur through digital payment services. Still, a consultation by the European Central Bank identified privacy as users' most valued feature in a potential digital euro.

Key factors influencing user adoption include:

- Transaction costs (CBDCs offer rates as low as 0.1% compared to traditional 2% credit card fees)

- Security features (CBDCs incorporate advanced cryptographic verification)

- Offline functionality (crucial for remote areas and natural disaster scenarios)

The success of CBDCs ultimately depends on achieving equilibrium between regulatory compliance and user privacy. Central banks must address cybersecurity concerns, as security breaches could severely impact user trust. Accordingly, many jurisdictions are implementing strict legal frameworks to limit government access to transaction data without proper oversight.

Conclusion

CBDCs stand poised to reshape our financial system fundamentally. Although central banks worldwide race to implement these digital currencies, cryptocurrency markets demonstrate remarkable resilience. Bitcoin price movements actually show positive correlations with CBDC developments, suggesting these technologies might complement rather than compete with each other.

The evidence points toward a hybrid future where CBDCs, cryptocurrencies, and stablecoins serve different market needs. Central banks prioritize control and oversight, while crypto maintains its appeal through privacy features and decentralization. This dynamic creates opportunities for both systems to thrive, albeit under different regulatory frameworks.